Wells Fargo & Co (WFC

) reported an increase in its first quarter earnings on Friday, but results still fell short of analysts’ expectations.

) reported an increase in its first quarter earnings on Friday, but results still fell short of analysts’ expectations.

WFC’s Earnings in Brief

WFC reported earnings of $5.9 billion, or $1.05 per share, up from $5.2 billion, or 92 cents per share, a year ago. Revenue rose to $20.625 billion from $21.26 billion last year. On average, analysts expected to see earnings of 97 cents and $20.60 billion in revenue.CEO Commentary

Chairman and CEO John Stumpf commented on the company’s results: "Our solid first quarter results again demonstrated the ability of our diversified business model to perform for shareholders. Our 265,000 team members remained focused on achieving our vision of serving the financial needs of our customers as we grew loans, deposits and increased cross-sell. First quarter 2014 earnings were another record for our Company and capital levels continued to strengthen. Returning more capital to our shareholders has remained a priority for Wells Fargo and we were pleased to have received a non-objection to our 2014 CCAR submission, which included a proposed 17 percent common stock dividend increase to $0.35 per share in the second quarter of this year and higher planned share repurchases compared with 2013 repurchase activity. As we move forward in 2014, I am optimistic about the opportunities ahead and believe that we are well positioned for growth."

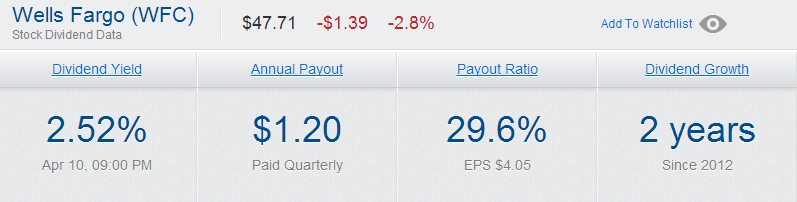

WFC’s Dividend

WFC paid its last quarterly dividend on March 1. We expect the bank to declare its next dividend sometime this month. It is likely that the next dividend will be increased.

See Also: History of Bank Stock Dividends: Still Little Recovery from Financial Crisis

Wells Fargo shares were down 19 cents, or 0.40%, during pre-market trading Friday. The stock is up 5.09% YTD.

WFC Dividend SnapshotAs of Market Close on April 10, 2014

Click here to see the complete history of WFC dividends.

No comments :

Post a Comment