BALTIMORE (Stockpickr) -- Another record close got booked in the S&P 500 yesterday, this time spurred by buying after an optimistic message from the Fed.

>>5 Stocks With Big Insider Buying

Year-to-date, the S&P has added 5.88% to its starting price, which means that it's on pace for 15.5% annualized total returns in 2014. That's a vastly different picture from where we stood just a couple of months ago, when the big index was actually down for the year. And, more important, it's creating some attractive trading opportunities in some of Wall Street's biggest names.

Today, we're turning to the charts for a technical look at five setups to trade for gains this week.

If you're new to technical analysis, here's the executive summary.

>>3 Huge Stocks on Traders' Radars

Technicals are a study of the market itself. Since the market is ultimately the only mechanism that determines a stock's price, technical analysis is a valuable tool even in the roughest of trading conditions. Technical charts are used every day by proprietary trading floors, Wall Street's biggest financial firms, and individual investors to get an edge on the market. And research shows that skilled technical traders can bank gains as much as 90% of the time.

Every week, I take an in-depth look at big names that are telling important technical stories. Here's this week's look at five high-volume stocks to trade this week.

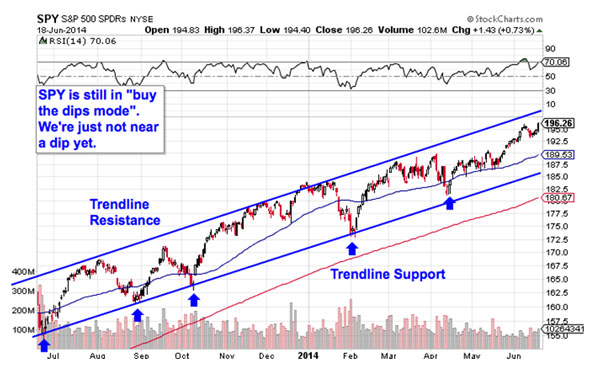

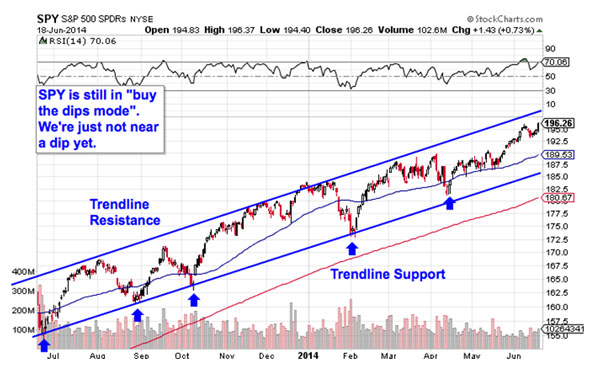

SPDR S&P 500 ETF

It makes sense to begin with the broad market. To do that, we'll turn to our best investible proxy for "stocks" as a group: the SPDR S&P 500 ETF (SPY). The S&P essentially went straight up for all of 2013, but 2014 became a lot harder to decode thanks to a deep correction in January and a sideways churn that spanned from March to the end of May.

>>Move In to Hedge Funds' 5 Favorite REITs This Summer

But through it all, the most important takeaway has been the fact that nothing really changed in 2014; the S&P continues to be a "buy the dips market". We've just got to wait for the next dip.

Since late 2012, the S&P has been bouncing its way higher within an uptrending channel defined by a pair of parallel trend lines. That channel still identifies the high-probability range for SPY to stay within. Every test of trend line support in those last 19 months has provided a low-risk buying opportunity for investors.

With the big index near the top of its channel right now, another correction looks likely toward the end of this month, but that will be followed up by another ideal buying opportunity for stocks near that trend line support level.

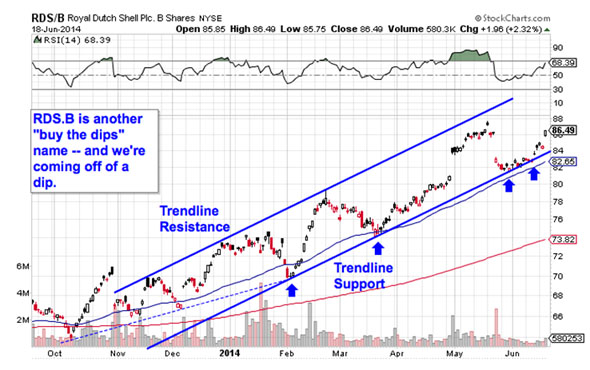

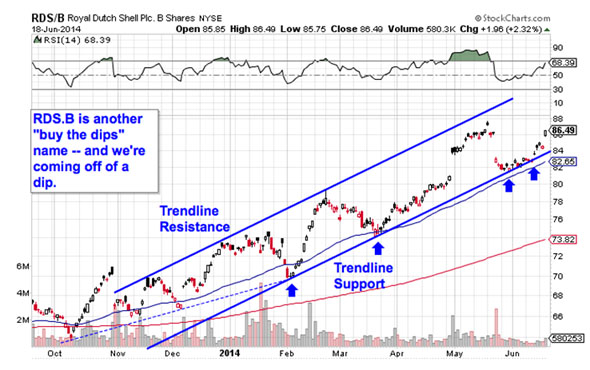

Royal Dutch Shell

We're seeing the same setup in shares of oil supermajor Royal Dutch Shell (RDS.B) right now, with the key difference that the chart for RDS.B looks buyable here -- no waiting required. Like The S&P, Shell is bouncing its way higher in an uptrending channel right now. While Shell's channel hasn't been intact for quite as long as the one in the S&P 500, the trading implications are just the same: buy the bounce.

>>4 Big Stocks to Trade (or Not)

Waiting for a bounce is important for two key reasons: It's the spot where shares have the furthest to move up before they hit resistance, and it's the spot where the risk is the least (because shares have the least room to move lower before you know you're wrong). Remember, all trend lines do eventually break, but by actually waiting for the bounce to happen first, you're ensuring RDS.B can actually still catch a bid along that line before you put your money on shares. We got our bounce at the beginning of this week.

If you decide to jump into Shell here, I'd recommend keeping a protective stop at the 50-day moving average. That level has been a solid proxy for support on the way up, so if it gets broken, you don't want to own Shell anymore.

Wyndham Worldwide

2014 has been a pretty tepid year for shares of hotel and timeshare company Wyndham Worldwide (WYN). As I write, shares are down 0.73% from their 2013 close. But that sideways churn is setting the stage for a buyable breakout in this $9.3 billion name. Here's how to trade it.

>>5 Stocks Set to Soar on Bullish Earnings

Wyndham is currently forming an ascending triangle pattern, a bullish setup that's formed by horizontal resistance above shares at $75 and uptrending support to the downside. Basically, as WYN bounces in between those two levels, it's getting squeezed closer and closer to a breakout above that $75 resistance level. When that happens, it's time to be a buyer.

Why all of that significance at $75? It all comes down to buyers and sellers. Price patterns are a good quick way to identify what's going on in the price action, but they're not the actual reason a stock is tradable. Instead, the "why" comes down to basic supply and demand for Wyndham's stock.

The $75 resistance level is a price where there has been an excess of supply of shares; in other words, it's a spot where sellers have previously been more eager to step in and take gains than buyers have been to buy. That's what makes a breakout above $75 so significant -- the move means that buyers are finally strong enough to absorb all of the excess supply above that price level.

Accenture

Accenture (ACN) hasn't exactly been exciting either this year -- the $55 billion consulting firm has spent the last six months consolidating sideways. But like WYN, that sideways churn is actually setting the stage for a meaningful breakout. The level to watch in ACN is $84.

>>3 Big-Volume Stocks to Trade for Breakouts

Accenture is forming a rectangle pattern, a price setup that's formed by a pair of horizontal resistance and support levels that basically "box in" shares between $84 and $77. Consolidations like the one in Accenture are common after big moves (like the double-digit rally Accenture booked in 2013); they give the stock a chance to bleed off momentum as buyers and sellers figure out their next move.

Rectangles are "if/then patterns." Put a different way, if Accenture breaks out through resistance at $84, then traders have a buy signal. Otherwise, if the stock violates support at $77, then the high-probability trade is a sell. Since ACN's price action leading up to the rectangle was an uptrend, it favors breaking out above $84.

As usual, keep a tight stop in place if you decide to be a buyer on the move.

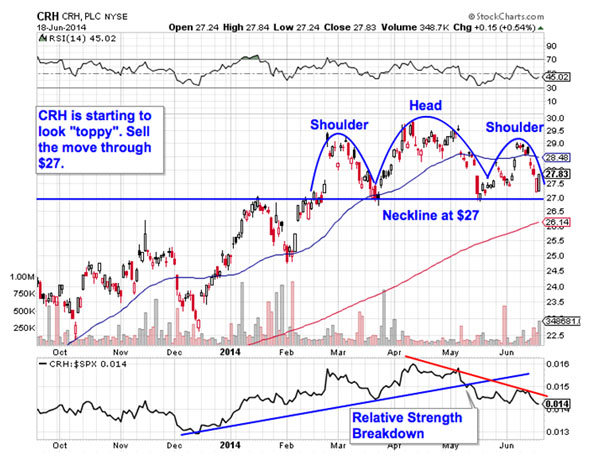

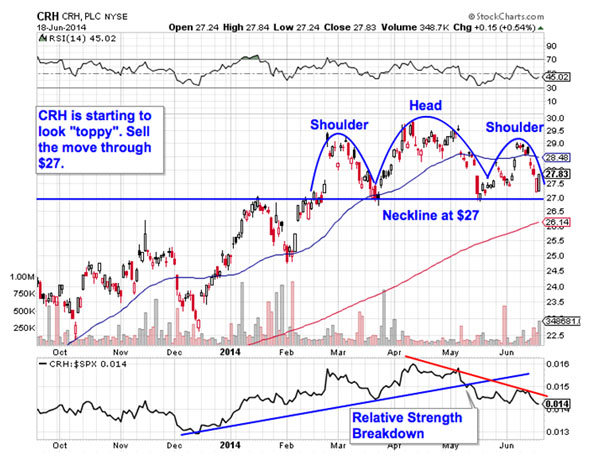

CRH

Not all of the names we're looking at today are bullish. In fact, shares of building materials company CRH (CRH) looks downright bearish thanks to a classical reversal pattern that's seen setting up in shares for the last few months. Now, with shares of CRH within grabbing distance of a key breakdown level, this stock is close to triggering a big sell (or short) signal.

CRH is currently forming a head and shoulders top, a setup that indicates exhaustion among buyers. The setup is formed by two swing highs that top out at approximately the same level (the shoulders), separated by a higher high (the head). The sell signal comes on a move through CRH's neckline, which is currently right at $27. If shares violate that neckline level, look for $22.50 as the next-nearest support level where shares could catch a bid again.

We're seeing that confirmed by relative strength right now. CRH's relative strength uptrend broke in early May, a signal that shares are statistically more apt to underperform the S&P 500 for the next three-to-ten month span. Buyers beware.

To see this week's trades in action, check out the Must-See Charts portfolio on Stockpickr.

-- Written by Jonas Elmerraji in Baltimore.

RELATED LINKS:

>>3 Stocks Under $10 Making Big Moves

>>5 Retail Stocks to Trade for Gains in June

>>5 Rocket Stocks to Buy for a Correction Week

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in the names mentioned.

Jonas Elmerraji, CMT, is a senior market analyst at Agora Financial in Baltimore and a contributor to

TheStreet. Before that, he managed a portfolio of stocks for an investment advisory returned 15% in 2008. He has been featured in Forbes , Investor's Business Daily, and on CNBC.com. Jonas holds a degree in financial economics from UMBC and the Chartered Market Technician designation.

Follow Jonas on Twitter @JonasElmerraji

Getty Images President Obama's new budget proposal includes changing a couple of key inflation calculations to something called a "chained CPI." The shift is getting a lot of attention right now because of the expected effect it will have on individuals. There are two key places where a chained CPI -- short for consumer price index -- will have a direct impact on your pocketbook: income taxes and Social Security benefits. All else being equal, over time, your income taxes will be higher and your Social Security benefits will be lower than they are under current inflation calculations. The key difference between the chained CPI and the traditional consumer price index is how the index measures consumer behavior. The chained CPI assumes that as prices rise on one product, some portion of consumers will be willing to substitute less expensive alternatives for what they used to buy. That changes the product weightings used in the inflation calculation. By incorporating information from those new product weightings, the chained CPI typically produces a lower inflation level. Here's how it works. The Impact on Income Taxes If you pay income taxes, your tax bracket is determined by the amount of taxable income you make. The cutoffs for each bracket generally rise over time with inflation. The two charts below show the IRS "Schedule X" brackets for single taxpayers; the first is for 2012, and the second is what's currently expected for 2013:

Getty Images President Obama's new budget proposal includes changing a couple of key inflation calculations to something called a "chained CPI." The shift is getting a lot of attention right now because of the expected effect it will have on individuals. There are two key places where a chained CPI -- short for consumer price index -- will have a direct impact on your pocketbook: income taxes and Social Security benefits. All else being equal, over time, your income taxes will be higher and your Social Security benefits will be lower than they are under current inflation calculations. The key difference between the chained CPI and the traditional consumer price index is how the index measures consumer behavior. The chained CPI assumes that as prices rise on one product, some portion of consumers will be willing to substitute less expensive alternatives for what they used to buy. That changes the product weightings used in the inflation calculation. By incorporating information from those new product weightings, the chained CPI typically produces a lower inflation level. Here's how it works. The Impact on Income Taxes If you pay income taxes, your tax bracket is determined by the amount of taxable income you make. The cutoffs for each bracket generally rise over time with inflation. The two charts below show the IRS "Schedule X" brackets for single taxpayers; the first is for 2012, and the second is what's currently expected for 2013:  Chart for 2012 from the U.S. Internal Revenue Service

Chart for 2012 from the U.S. Internal Revenue Service  Chart for 2013 from the U.S. Internal Revenue Service While the 39.6 percent tax rate is new for 2013, note that the other brackets have higher cutoffs for 2013 than they did for 2012. That's thanks to the inflation adjustment made to the tax brackets. If the law is changed so that the chained CPI is used, the tops of those brackets are expected to rise more slowly, exposing more of your income to higher tax rates than under current law. The Effect on Social Security Benefits Similarly, Social Security benefits are increased based on the inflation rate. By tying the payment increases to the chained CPI -- an inflation rate that grows more slowly than the current measure -- those benefit payments will grow less quickly as well. As a result, over time your Social Security checks will be smaller than they would have been under the old inflation calculation. The annual changes aren't too extreme -- they're estimated to be somewhere in the vicinity of 0.1 percent to 0.3 percent per year, depending on what the future brings. But over time, it adds up to real money for those who pay income taxes or receive Social Security checks, with official estimates in the neighborhood of $340 billion in higher taxes and lower costs over the next 10 years. Is It Better? Is It Fair? To some extent, the chained CPI is more effective at measuring the behavior changes that we all make whenever possible to save some cash. For example, if you've switched to generic medications whenever they're available, you're doing exactly what the chained CPI expects you to do. Likewise, if you started carpooling or taking the bus in response to higher gas prices, you're changing your behavior based on higher prices, just like the chained CPI projects. On the flip side, of course, not all costs are easily switchable, especially for the seniors who rely on Social Security. For instance, health care costs have been rising faster than the overall inflation rate for decades, and older folks generally have higher health care costs than younger ones do. As a result, the change to a chained CPI will very likely make the gap between income growth and health care spending growth even more painful for seniors on Social Security. The Big Picture Still, if slowing the rate of benefit increases puts off the day of reckoning for when the Social Security Trust Fund runs out of cash and slashes benefits by around 25 percent, it may be worth it. That date is currently estimated to be a mere 20 years away -- well within the expected life span of most current workers and even some early retirees. To make it worse, if the CBO's recent release on Social Security is any indication, the next Social Security Trustees' Report may even pull that date even closer. Given a choice between a slower rate of growth or a hard slash of 25 percent at some point in the not-too-distant future, neither option seems ideal. But still, a slower rate of growth is a lot less painful than waking up one day to find your sole source of income has shrunk by a quarter of its former value.

Chart for 2013 from the U.S. Internal Revenue Service While the 39.6 percent tax rate is new for 2013, note that the other brackets have higher cutoffs for 2013 than they did for 2012. That's thanks to the inflation adjustment made to the tax brackets. If the law is changed so that the chained CPI is used, the tops of those brackets are expected to rise more slowly, exposing more of your income to higher tax rates than under current law. The Effect on Social Security Benefits Similarly, Social Security benefits are increased based on the inflation rate. By tying the payment increases to the chained CPI -- an inflation rate that grows more slowly than the current measure -- those benefit payments will grow less quickly as well. As a result, over time your Social Security checks will be smaller than they would have been under the old inflation calculation. The annual changes aren't too extreme -- they're estimated to be somewhere in the vicinity of 0.1 percent to 0.3 percent per year, depending on what the future brings. But over time, it adds up to real money for those who pay income taxes or receive Social Security checks, with official estimates in the neighborhood of $340 billion in higher taxes and lower costs over the next 10 years. Is It Better? Is It Fair? To some extent, the chained CPI is more effective at measuring the behavior changes that we all make whenever possible to save some cash. For example, if you've switched to generic medications whenever they're available, you're doing exactly what the chained CPI expects you to do. Likewise, if you started carpooling or taking the bus in response to higher gas prices, you're changing your behavior based on higher prices, just like the chained CPI projects. On the flip side, of course, not all costs are easily switchable, especially for the seniors who rely on Social Security. For instance, health care costs have been rising faster than the overall inflation rate for decades, and older folks generally have higher health care costs than younger ones do. As a result, the change to a chained CPI will very likely make the gap between income growth and health care spending growth even more painful for seniors on Social Security. The Big Picture Still, if slowing the rate of benefit increases puts off the day of reckoning for when the Social Security Trust Fund runs out of cash and slashes benefits by around 25 percent, it may be worth it. That date is currently estimated to be a mere 20 years away -- well within the expected life span of most current workers and even some early retirees. To make it worse, if the CBO's recent release on Social Security is any indication, the next Social Security Trustees' Report may even pull that date even closer. Given a choice between a slower rate of growth or a hard slash of 25 percent at some point in the not-too-distant future, neither option seems ideal. But still, a slower rate of growth is a lot less painful than waking up one day to find your sole source of income has shrunk by a quarter of its former value.  Kevork Djansezian/Bloomberg via Getty Images WASHINGTON -- While the appearance of the deadly Ebola virus in Texas is worrying the nation, it has yet to lead Americans to take a more cautious view over how to spend their money, data suggested Friday. The Thomson Reuters/University of Michigan index of consumer sentiment unexpectedly rose in early October to its highest level since July 2007. Separate data showed groundbreaking for new homes rose more than expected last month, and taken together the reports pointed to solid U.S. economic growth. "The underlying strength of the U.S. economy remains intact," said David Berson, an economist at Nationwide Mutual Insurance in Columbus, Ohio. "If it were not for Ebola and geopolitical concerns, these [sentiment] numbers would be higher." The data for the sentiment survey was collected Sept. 25 to Oct. 15, a period in which Americans have been barraged by news of Ebola's spread in West Africa, where it has killed thousands, and its appearance in the United States. U.S. officials have confirmed three Ebola cases, all in Dallas, since Sept. 30 -- a Liberian man who later died of the disease and two nurses who had cared for him and are now being treated. Investors have been concerned that Ebola, if not contained in the United States, could scare consumers and lead them to cut back on spending, though there is little sign of that so far. The consumer sentiment survey period also overlapped with the global stock market sell-off earlier this week. Economists polled by Reuters had expected the sentiment index to fall, but instead it ticked two tenths of a point higher to 86.4. Consumers were more upbeat about their personal finances and the national economy. Other measures of consumer confidence have also failed to show much alarm. Gallup's daily poll of economic sentiment has been stable in recent weeks. At least when it comes to spending decisions, consumers remain focused on a strengthening economy. "Despite rising media coverage, Ebola seems to have had little discernible effect on consumer sentiment to date," Goldman Sachs analyst Kris Dawsey said. The U.S. unemployment rate fell to 5.9 percent last month, a six-year low. Investors think the stronger job market will lead the Federal Reserve to raise interest rates next year after holding them near zero since 2008, though worries about the global economy and chronically low inflation have recently led them to bet the hike would be delayed until late in the year. Housing Recovery Intact A stronger job market helped the housing market recovery to advance last month, with groundbreaking at building sites rising more than expected. Housing starts rose 6.3 percent to an annual 1.02 million-unit pace, the Commerce Department said, the latest sign the sector was continuing to claw back after the implosion that touched off the 2007-2009 financial crisis and recession. Newly issued permits also rose. "If you look at the trend, you are still seeing an upward trajectory," said Michelle Meyers, an economist at Bank of America Merrill Lynch (BAC) in New York. U.S. stock prices jumped following a batch of solid corporate earnings reports, including profits by General Electric (GE) that topped analyst expectations. Share prices had fallen sharply earlier in the week, and the bounceback sucked money away from U.S. government debt, pushing yields higher for a second straight day. -

Kevork Djansezian/Bloomberg via Getty Images WASHINGTON -- While the appearance of the deadly Ebola virus in Texas is worrying the nation, it has yet to lead Americans to take a more cautious view over how to spend their money, data suggested Friday. The Thomson Reuters/University of Michigan index of consumer sentiment unexpectedly rose in early October to its highest level since July 2007. Separate data showed groundbreaking for new homes rose more than expected last month, and taken together the reports pointed to solid U.S. economic growth. "The underlying strength of the U.S. economy remains intact," said David Berson, an economist at Nationwide Mutual Insurance in Columbus, Ohio. "If it were not for Ebola and geopolitical concerns, these [sentiment] numbers would be higher." The data for the sentiment survey was collected Sept. 25 to Oct. 15, a period in which Americans have been barraged by news of Ebola's spread in West Africa, where it has killed thousands, and its appearance in the United States. U.S. officials have confirmed three Ebola cases, all in Dallas, since Sept. 30 -- a Liberian man who later died of the disease and two nurses who had cared for him and are now being treated. Investors have been concerned that Ebola, if not contained in the United States, could scare consumers and lead them to cut back on spending, though there is little sign of that so far. The consumer sentiment survey period also overlapped with the global stock market sell-off earlier this week. Economists polled by Reuters had expected the sentiment index to fall, but instead it ticked two tenths of a point higher to 86.4. Consumers were more upbeat about their personal finances and the national economy. Other measures of consumer confidence have also failed to show much alarm. Gallup's daily poll of economic sentiment has been stable in recent weeks. At least when it comes to spending decisions, consumers remain focused on a strengthening economy. "Despite rising media coverage, Ebola seems to have had little discernible effect on consumer sentiment to date," Goldman Sachs analyst Kris Dawsey said. The U.S. unemployment rate fell to 5.9 percent last month, a six-year low. Investors think the stronger job market will lead the Federal Reserve to raise interest rates next year after holding them near zero since 2008, though worries about the global economy and chronically low inflation have recently led them to bet the hike would be delayed until late in the year. Housing Recovery Intact A stronger job market helped the housing market recovery to advance last month, with groundbreaking at building sites rising more than expected. Housing starts rose 6.3 percent to an annual 1.02 million-unit pace, the Commerce Department said, the latest sign the sector was continuing to claw back after the implosion that touched off the 2007-2009 financial crisis and recession. Newly issued permits also rose. "If you look at the trend, you are still seeing an upward trajectory," said Michelle Meyers, an economist at Bank of America Merrill Lynch (BAC) in New York. U.S. stock prices jumped following a batch of solid corporate earnings reports, including profits by General Electric (GE) that topped analyst expectations. Share prices had fallen sharply earlier in the week, and the bounceback sucked money away from U.S. government debt, pushing yields higher for a second straight day. -

) announced that it will acquire the assets of Navarro Discount Pharmacy.

) announced that it will acquire the assets of Navarro Discount Pharmacy.

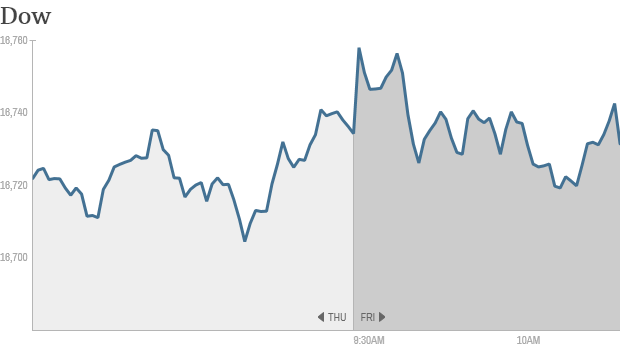

NEW YORK (CNNMoney) For a summer Friday, markets are feeling a bit feisty. From Iraq to Priceline, there's much for investors to weigh.

NEW YORK (CNNMoney) For a summer Friday, markets are feeling a bit feisty. From Iraq to Priceline, there's much for investors to weigh.  Bloomberg News

Bloomberg News  Alamy Tax season is a time of stress for many, but it can be a joyful time for the roughly 75 percent of Americans who receive income tax refunds. While the refund really means you're getting back money you loaned to the government at no interest, in practical terms it often means an unexpected infusion of cash into your wallet or bank account. Last year's average income tax refund was $2,755, according to the Internal Revenue Service. That's a nice chunk of change. It's a great problem to have: What do you do with your windfall? The best choice for one person may not be the best choice for another. But experts agree on one thing: If you have debt, apply your refund to paying it off, whether it's credit card debt, student loan debt or other consumer debt. "People should still be focusing first on paying down debt," says Meisa Bonelli, a Wall Street finance and tax professional whose Millennial Tax company advises entrepreneurs on business and tax strategy. Debt, particularly student loan debt, should be a primary target because it limits financial options, preventing people from doing what they want with their money, whether it's buying a house, buying a car or taking a vacation. "Get that debt gone," she says. "It holds you back from everything else you want to do in life." Eric Rosenberg, a financial analyst who writes the blog Narrow Bridge Finance, agrees. "The No. 1 thing anyone should do with a tax refund is pay down debt," he says. After he left graduate school with $40,000 in student loan debt, he focused on aggressively paying it off. Using all his tax refunds and bonuses, he made the final payment just two years and six days after his graduation. With his student loan debt cleared away, he began saving his tax refunds, with the goal of buying a home. He didn't apply any of his refund money to splurges -- instead, he saved for fun and vacation with his regular income. The refunds were earmarked for bigger things. "I treated it like it was extra money that I didn't need to live on," Rosenberg says. "I always encourage people to think long term, not short term." Others believe that giving yourself license to splurge with part of your refund helps you save the rest. Stephanie Halligan, a financial consultant and blogger, signs a contract with herself before she does her taxes, allocating 50 percent of her refund to student loans and 25 percent to long-term savings. She can spend the remaining 25 percent on whatever she wants. "It's easy to react on impulse and emotion when your refund hits, so prepare now for what you'll do with that moolah later," she advises on her personal finance website, The Empowered Dollar. If you're getting a big refund -- a check in the ballpark of $1,000 or more for taxpayers who don't have a side business -- consider adjusting your withholding so that you'll have that money available to you during the year. But those who don't have substantial savings want to avoid a scenario in which they owe four figures to the IRS at tax time. "I think people should withhold the maximum they can withhold," Bonelli says. Rosenberg concurs. As his businesses, running Narrow Bridge Finance and building websites, have grown, his refunds have shrunk. Last year he had to pay the IRS. Here are the seven smartest things you can do with your refund: Pay down debt. If you have any consumer debt -- student loans, credit card balances or installment loans -- pay those off before using your refund for any other purpose. Car payments and home mortgages aren't in this category, but you can consider paying extra principal. Add to your savings. "You can never save enough," Bonelli says. You can use the money to build up your emergency fund, your kids' college funds or put it toward a specific goal, such as buying a house or a car or financing a big vacation. Add to your retirement accounts. If you put $2,500 from this year's tax refund into an IRA, it would grow to $8,500 in 25 years, even at a modest 5 percent rate of return, TurboTax calculates. If you saved $2,500 every year for 25 years, you'd end up with more than $130,000 at that same 5 percent rate of return. Invest in yourself. This could mean taking a class in investing, studying something that interests you or even taking a big trip. "Do something that enriches yourself or adds value to your life," Bonelli says. She is planning to take a class in art therapy this year using money from her refund. Improve your home. Consider putting your refund to good use by adding insulation, replacing old windows and doors or other improvements that would save energy, and therefore money. Or perhaps it's time to remodel your bathroom or kitchen. You're adding value to your home at the same time you're improving your living experience. Apply your refund toward next year's taxes. This is common among self-employed taxpayers, who are required to pay quarterly taxes since they don't have taxes withheld. By applying any overpayment toward upcoming tax payments, you can free up other cash.

Alamy Tax season is a time of stress for many, but it can be a joyful time for the roughly 75 percent of Americans who receive income tax refunds. While the refund really means you're getting back money you loaned to the government at no interest, in practical terms it often means an unexpected infusion of cash into your wallet or bank account. Last year's average income tax refund was $2,755, according to the Internal Revenue Service. That's a nice chunk of change. It's a great problem to have: What do you do with your windfall? The best choice for one person may not be the best choice for another. But experts agree on one thing: If you have debt, apply your refund to paying it off, whether it's credit card debt, student loan debt or other consumer debt. "People should still be focusing first on paying down debt," says Meisa Bonelli, a Wall Street finance and tax professional whose Millennial Tax company advises entrepreneurs on business and tax strategy. Debt, particularly student loan debt, should be a primary target because it limits financial options, preventing people from doing what they want with their money, whether it's buying a house, buying a car or taking a vacation. "Get that debt gone," she says. "It holds you back from everything else you want to do in life." Eric Rosenberg, a financial analyst who writes the blog Narrow Bridge Finance, agrees. "The No. 1 thing anyone should do with a tax refund is pay down debt," he says. After he left graduate school with $40,000 in student loan debt, he focused on aggressively paying it off. Using all his tax refunds and bonuses, he made the final payment just two years and six days after his graduation. With his student loan debt cleared away, he began saving his tax refunds, with the goal of buying a home. He didn't apply any of his refund money to splurges -- instead, he saved for fun and vacation with his regular income. The refunds were earmarked for bigger things. "I treated it like it was extra money that I didn't need to live on," Rosenberg says. "I always encourage people to think long term, not short term." Others believe that giving yourself license to splurge with part of your refund helps you save the rest. Stephanie Halligan, a financial consultant and blogger, signs a contract with herself before she does her taxes, allocating 50 percent of her refund to student loans and 25 percent to long-term savings. She can spend the remaining 25 percent on whatever she wants. "It's easy to react on impulse and emotion when your refund hits, so prepare now for what you'll do with that moolah later," she advises on her personal finance website, The Empowered Dollar. If you're getting a big refund -- a check in the ballpark of $1,000 or more for taxpayers who don't have a side business -- consider adjusting your withholding so that you'll have that money available to you during the year. But those who don't have substantial savings want to avoid a scenario in which they owe four figures to the IRS at tax time. "I think people should withhold the maximum they can withhold," Bonelli says. Rosenberg concurs. As his businesses, running Narrow Bridge Finance and building websites, have grown, his refunds have shrunk. Last year he had to pay the IRS. Here are the seven smartest things you can do with your refund: Pay down debt. If you have any consumer debt -- student loans, credit card balances or installment loans -- pay those off before using your refund for any other purpose. Car payments and home mortgages aren't in this category, but you can consider paying extra principal. Add to your savings. "You can never save enough," Bonelli says. You can use the money to build up your emergency fund, your kids' college funds or put it toward a specific goal, such as buying a house or a car or financing a big vacation. Add to your retirement accounts. If you put $2,500 from this year's tax refund into an IRA, it would grow to $8,500 in 25 years, even at a modest 5 percent rate of return, TurboTax calculates. If you saved $2,500 every year for 25 years, you'd end up with more than $130,000 at that same 5 percent rate of return. Invest in yourself. This could mean taking a class in investing, studying something that interests you or even taking a big trip. "Do something that enriches yourself or adds value to your life," Bonelli says. She is planning to take a class in art therapy this year using money from her refund. Improve your home. Consider putting your refund to good use by adding insulation, replacing old windows and doors or other improvements that would save energy, and therefore money. Or perhaps it's time to remodel your bathroom or kitchen. You're adding value to your home at the same time you're improving your living experience. Apply your refund toward next year's taxes. This is common among self-employed taxpayers, who are required to pay quarterly taxes since they don't have taxes withheld. By applying any overpayment toward upcoming tax payments, you can free up other cash. Getty Images/Blend Images RM A major in theater often sits atop lists of the most useless college degrees, but by studying theater as an undergrad, I actually think I learned how to bootstrap my business. (I also went to a state college, so it was an affordable theater degree. Shout out to Minnesota State University - Mankato!) Here's a list of the valuable skills I acquired there that I've taken to heart over the last 10 years, and how they affect my business today. 1. Show Up In theater, if you don't audition, you won't get cast. You have to put yourself out there. Nowadays, I email people I don't know. I didn't know that this was weird. I've always reached out to people whose work I admire. I email people every week, and I don't expect anything in return. Sometimes I get an email back; sometimes I don't. But that's OK, because I just wanted to let that person know how his or her work has affected me. In theater, you audition for show after show after show, and you rarely get cast -- but if you don't put yourself out there, you'll never get cast. People ask how I've managed to get so much press in the past year; the answer simple: I'm not afraid to put myself out there. 2. Connect With People Immediately Theater always attracts the most interesting characters, and you learn to accept people for their uniqueness. You also learn how to get along with people who drive you nuts. More importantly, theater taught me how to connect with people instantly. I love finding out what others are interested in and connecting them with others who share their interests. I learned (just a few years ago) that this is called "networking." I thought everyone did this!

Getty Images/Blend Images RM A major in theater often sits atop lists of the most useless college degrees, but by studying theater as an undergrad, I actually think I learned how to bootstrap my business. (I also went to a state college, so it was an affordable theater degree. Shout out to Minnesota State University - Mankato!) Here's a list of the valuable skills I acquired there that I've taken to heart over the last 10 years, and how they affect my business today. 1. Show Up In theater, if you don't audition, you won't get cast. You have to put yourself out there. Nowadays, I email people I don't know. I didn't know that this was weird. I've always reached out to people whose work I admire. I email people every week, and I don't expect anything in return. Sometimes I get an email back; sometimes I don't. But that's OK, because I just wanted to let that person know how his or her work has affected me. In theater, you audition for show after show after show, and you rarely get cast -- but if you don't put yourself out there, you'll never get cast. People ask how I've managed to get so much press in the past year; the answer simple: I'm not afraid to put myself out there. 2. Connect With People Immediately Theater always attracts the most interesting characters, and you learn to accept people for their uniqueness. You also learn how to get along with people who drive you nuts. More importantly, theater taught me how to connect with people instantly. I love finding out what others are interested in and connecting them with others who share their interests. I learned (just a few years ago) that this is called "networking." I thought everyone did this!