BALTIMORE (Stockpickr) -- Another record close got booked in the S&P 500 yesterday, this time spurred by buying after an optimistic message from the Fed.

>>5 Stocks With Big Insider Buying

Year-to-date, the S&P has added 5.88% to its starting price, which means that it's on pace for 15.5% annualized total returns in 2014. That's a vastly different picture from where we stood just a couple of months ago, when the big index was actually down for the year. And, more important, it's creating some attractive trading opportunities in some of Wall Street's biggest names.

Today, we're turning to the charts for a technical look at five setups to trade for gains this week.

If you're new to technical analysis, here's the executive summary.

>>3 Huge Stocks on Traders' Radars

Technicals are a study of the market itself. Since the market is ultimately the only mechanism that determines a stock's price, technical analysis is a valuable tool even in the roughest of trading conditions. Technical charts are used every day by proprietary trading floors, Wall Street's biggest financial firms, and individual investors to get an edge on the market. And research shows that skilled technical traders can bank gains as much as 90% of the time.

Every week, I take an in-depth look at big names that are telling important technical stories. Here's this week's look at five high-volume stocks to trade this week.

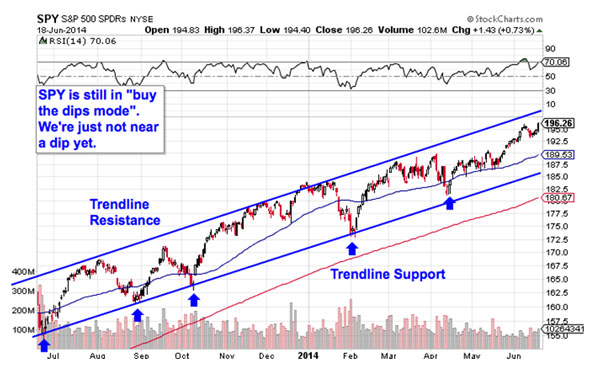

SPDR S&P 500 ETF

It makes sense to begin with the broad market. To do that, we'll turn to our best investible proxy for "stocks" as a group: the SPDR S&P 500 ETF (SPY). The S&P essentially went straight up for all of 2013, but 2014 became a lot harder to decode thanks to a deep correction in January and a sideways churn that spanned from March to the end of May.

>>Move In to Hedge Funds' 5 Favorite REITs This Summer

But through it all, the most important takeaway has been the fact that nothing really changed in 2014; the S&P continues to be a "buy the dips market". We've just got to wait for the next dip.

Since late 2012, the S&P has been bouncing its way higher within an uptrending channel defined by a pair of parallel trend lines. That channel still identifies the high-probability range for SPY to stay within. Every test of trend line support in those last 19 months has provided a low-risk buying opportunity for investors.

With the big index near the top of its channel right now, another correction looks likely toward the end of this month, but that will be followed up by another ideal buying opportunity for stocks near that trend line support level.

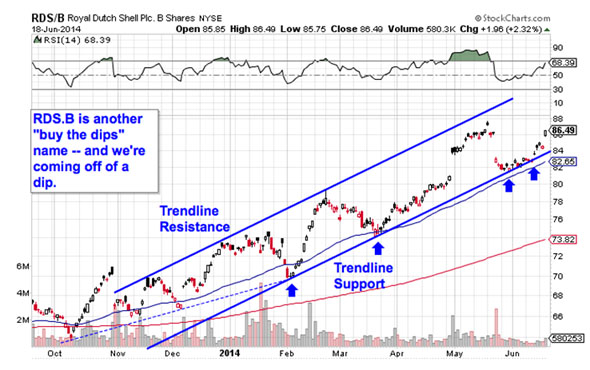

Royal Dutch Shell

We're seeing the same setup in shares of oil supermajor Royal Dutch Shell (RDS.B) right now, with the key difference that the chart for RDS.B looks buyable here -- no waiting required. Like The S&P, Shell is bouncing its way higher in an uptrending channel right now. While Shell's channel hasn't been intact for quite as long as the one in the S&P 500, the trading implications are just the same: buy the bounce.

>>4 Big Stocks to Trade (or Not)

Waiting for a bounce is important for two key reasons: It's the spot where shares have the furthest to move up before they hit resistance, and it's the spot where the risk is the least (because shares have the least room to move lower before you know you're wrong). Remember, all trend lines do eventually break, but by actually waiting for the bounce to happen first, you're ensuring RDS.B can actually still catch a bid along that line before you put your money on shares. We got our bounce at the beginning of this week.

If you decide to jump into Shell here, I'd recommend keeping a protective stop at the 50-day moving average. That level has been a solid proxy for support on the way up, so if it gets broken, you don't want to own Shell anymore.

Wyndham Worldwide

2014 has been a pretty tepid year for shares of hotel and timeshare company Wyndham Worldwide (WYN). As I write, shares are down 0.73% from their 2013 close. But that sideways churn is setting the stage for a buyable breakout in this $9.3 billion name. Here's how to trade it.

>>5 Stocks Set to Soar on Bullish Earnings

Wyndham is currently forming an ascending triangle pattern, a bullish setup that's formed by horizontal resistance above shares at $75 and uptrending support to the downside. Basically, as WYN bounces in between those two levels, it's getting squeezed closer and closer to a breakout above that $75 resistance level. When that happens, it's time to be a buyer.

Why all of that significance at $75? It all comes down to buyers and sellers. Price patterns are a good quick way to identify what's going on in the price action, but they're not the actual reason a stock is tradable. Instead, the "why" comes down to basic supply and demand for Wyndham's stock.

The $75 resistance level is a price where there has been an excess of supply of shares; in other words, it's a spot where sellers have previously been more eager to step in and take gains than buyers have been to buy. That's what makes a breakout above $75 so significant -- the move means that buyers are finally strong enough to absorb all of the excess supply above that price level.

Accenture

Accenture (ACN) hasn't exactly been exciting either this year -- the $55 billion consulting firm has spent the last six months consolidating sideways. But like WYN, that sideways churn is actually setting the stage for a meaningful breakout. The level to watch in ACN is $84.

>>3 Big-Volume Stocks to Trade for Breakouts

Accenture is forming a rectangle pattern, a price setup that's formed by a pair of horizontal resistance and support levels that basically "box in" shares between $84 and $77. Consolidations like the one in Accenture are common after big moves (like the double-digit rally Accenture booked in 2013); they give the stock a chance to bleed off momentum as buyers and sellers figure out their next move.

Rectangles are "if/then patterns." Put a different way, if Accenture breaks out through resistance at $84, then traders have a buy signal. Otherwise, if the stock violates support at $77, then the high-probability trade is a sell. Since ACN's price action leading up to the rectangle was an uptrend, it favors breaking out above $84.

As usual, keep a tight stop in place if you decide to be a buyer on the move.

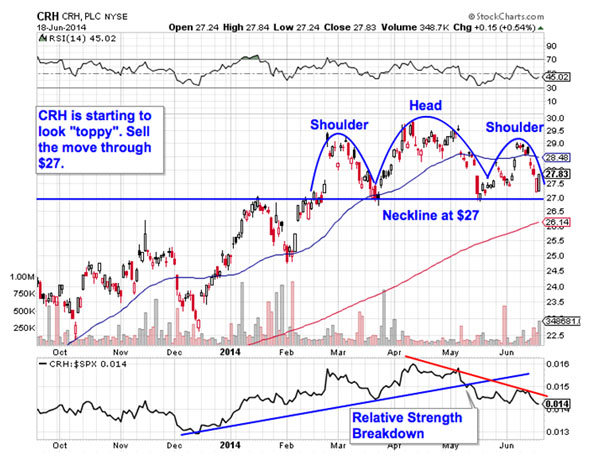

CRH

Not all of the names we're looking at today are bullish. In fact, shares of building materials company CRH (CRH) looks downright bearish thanks to a classical reversal pattern that's seen setting up in shares for the last few months. Now, with shares of CRH within grabbing distance of a key breakdown level, this stock is close to triggering a big sell (or short) signal.

CRH is currently forming a head and shoulders top, a setup that indicates exhaustion among buyers. The setup is formed by two swing highs that top out at approximately the same level (the shoulders), separated by a higher high (the head). The sell signal comes on a move through CRH's neckline, which is currently right at $27. If shares violate that neckline level, look for $22.50 as the next-nearest support level where shares could catch a bid again.

We're seeing that confirmed by relative strength right now. CRH's relative strength uptrend broke in early May, a signal that shares are statistically more apt to underperform the S&P 500 for the next three-to-ten month span. Buyers beware.

To see this week's trades in action, check out the Must-See Charts portfolio on Stockpickr.

-- Written by Jonas Elmerraji in Baltimore.

RELATED LINKS:

>>3 Stocks Under $10 Making Big Moves

>>5 Retail Stocks to Trade for Gains in June

>>5 Rocket Stocks to Buy for a Correction Week

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in the names mentioned.

Jonas Elmerraji, CMT, is a senior market analyst at Agora Financial in Baltimore and a contributor to

TheStreet. Before that, he managed a portfolio of stocks for an investment advisory returned 15% in 2008. He has been featured in Forbes , Investor's Business Daily, and on CNBC.com. Jonas holds a degree in financial economics from UMBC and the Chartered Market Technician designation.Follow Jonas on Twitter @JonasElmerraji

No comments :

Post a Comment