Leading Chinese search provider Baidu (BIDU) released strong first-quarter results. The company came up with fantastic financials, exceeding its own outlook. Baidu's core search business was performing well, driving the company's growth. Moreover, Baidu is confident of a better performance in the future, as the company is counting on the fast growing mobile segment. On the back of many key factors, Baidu can be a good long-term holding.

Strong financials

Baidu's financials were strong. Its quarterly revenue reported an impressive 59% growth as compared to last year's same quarter. Baidu also saw a good 8.8% growth in online marketing customers, which led the company to post a good 24% increase in net profit. On the earnings front, Baidu posted $1.23 per share, which outpaced consensus estimates of $1.04 per share.

Baidu is a famous name in China's internet industry. It has aggressive strategies to grow faster and move ahead of peers -- Alibaba Group and Tencent. Both these competitors are making impressive moves to capture untapped opportunities in the growing e-commerce business. To hold its ground, Baidu is investing in its core business as it transitions to mobile devices such as smartphones from PC search advertising.

Baidu is expanding its operations on the international front as well. Looking at its performance in the past, the promises look concrete. Baidu is laser-focused on mobile, cloud-based services, and customer products. These segments are expected to generate strong income, and give enormous opportunity to Baidu to tap markets in future. Baidu is stretching its foot print to different sectors such as media, retail, and travel, along with financial and local services that should generate strong margins for the company.

Growth ahead

Further, Baidu has its eyes on the growing mobile segment. The changing customer preferences from feature phones to smartphones is a great opportunity for many companies, and Baidu is also lining up to benefit from it. Seeing this, Baidu is taking steps to expand its operations in segments such as media, social, online tools to deliver world class services. According to some sources, internet users logging in from mobile devices have increased over time, and Baidu is looking to maximize its profit and improve its market share as a result.

Recent studies have revealed that internet mobile search is increasing day by day. The statistics show that the number of active users have increased from 130 million to 160 million in two quarters. Seeing this, Baidu wants to capture these growing opportunities. It is making moves to strengthen its channel distribution through a number of initiatives, such as optimizing ad formats on the search page, making click-to-call, click-to-download buttons, as well as location extensions on the product side. Such moves by the company will help it generate healthy returns in the future.

Moving forward, Baidu has added the Plus V verification program on the safety front, which is an attractive feature which will attract more users. Also, with this feature, users will be able to advertise on the search page, which will be accretive to its revenue as the company expects solid growth in its customer base with this system in place.

Conclusion

Looking at the ratios, Baidu is quite undervalued with a forward P/E of just 3.61. Baidu is continually reporting solid results which indicate that the company is moving forward. Also, its core fundamentals are strong, indicating that Baidu looks set to get better in the future.

| Currently 0.00/512345 Rating: 0.0/5 (0 votes) | |

Subscribe via Email

Subscribe RSS Comments Please leave your comment:

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

MORE GURUFOCUS LINKS

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

BIDU STOCK PRICE CHART

186.1 (1y: +83%) $(function(){var seriesOptions=[],yAxisOptions=[],name='BIDU',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1373864400000,101.59],[1373950800000,105.69],[1374037200000,108.53],[1374123600000,111.2],[1374210000000,111.08],[1374469200000,110.01],[1374555600000,109.84],[1374642000000,113.37],[1374728400000,125.85],[1374814800000,127.56],[1375074000000,129.33],[1375160400000,131.69],[1375246800000,132.31],[1375333200000,134.93],[1375419600000,139.699],[1375678800000,133.89],[1375765200000,134.56],[1375851600000,135.33],[1375938000000,135.74],[1376024400000,138.19],[1376283600000,136.73],[1376370000000,141.53],[1376456400000,138.51],[1376542800000,134.92],[1376629200000,134.64],[1376888400000,135.01],[1376974800000,134.96],[1377061200000,135.99],[1377147600000,139.54],[1377234000000,138.64],[1377493200000,139.02],[1377579600000,135.122],[1377666000000,138.98],[1377752400000,139.76],[1377838800000,135.53],[1378184400000,136.17],[1378270800000,134.49],[1378357200000,132.99],[1378443600000,135.67],[1378702800000,136.58],[1378789200000,140.6],[1378875600000,147.31],[1378962000000,144.5],[1379048400000,142.64],[1379307600000,142.59],[1379394000000,143.805],[1379480400000,145.7],[1379566800000,147.7],[1379653200000,146.25],[1379912400000,149.26],[1379998800000,150.13],[1380085200000,150.68],[1380171600000,154.28],[1380258000000,153.84],[1380517200000,155.18],[1380603600000,158.64],[1380690000000,159.94],[1380776400000,157.08],[1380862800000,159],[1381122000000,157.54],[1381208400000,148.75],[1381294800000,146.54],[1381381200000,153.16],[1381467600000,154.9],[1381726800000,152.96],[1381813200000,151.5],[1381899600000,150.2],[1381986000000,153.83],[1382072400000,165.91],[1382331600000,161.21],[1382418000000,158.57],[1382504400000,155.07],[1382590800000,161.34],[1382677200000,159.36],[1382936400000,154.12],[1383022800000,159.41],[1383109200000,164.934],[1383195600000,160.799],[1383282000000,160.06],[1383544800000,156.02],[1383631200000,153.462],[1383717600000,150.09],[1383804000000,147.35],[1383! 890400000,151.09],[1384149600000,151.6],[1384236000000,150.43],[1384322400000,152.98],[1384408800000,158.99],[1384495200000,162.33],[1384754400000,162.87],[1384840800000,163.12],[1384927200000,158.76],[1385013600000,158.404],[1385100000000,158.09],[1385359200000,156.66],[1385445600000,163.03],[1385532000000,162.99],[1385704800000,166.57],[1385964000000,168.66],[1386050400000,167.05],[1386136800000,168.26],[1386223200000,167.36],[1386309600000,168.71],[1386568800000,171.899],[1386655200000,179.93],[1386741600000,173.24],[1386828000000,171.5],[1386914400000,171.24],[1387173600000,169.01],[1387260000000,168.33],[1387346400000,171.49],[1387432800000,170.39],[1387519200000,173.36],[1387778400000,172.3],[1387864800000,168.578],[1388037600000,167.28],[1388124000000,173.77],[1388383200000,173.99],[1388469600000,177.88],[1388642400000,179.99],[1388728800000,175.28],[1388988000000,176.63],[1389074400000,178.82],[1389160800000,181.79],[1389247200000,175.52],[1389333600000,179.66],[1389592800000,171],[1389679200000,172.87],[1389765600000,170.5],[1389852000000,173],[1389938400000,170.14],[1390284000000,172.7],[1390370400000,174.43],[1390456800000,163.58],[1390543200000,161.37],[1390802400000,158.68],[1390888800000,164.24],[1390975200000,158.1],[1391061600000,160.

Reuters

Reuters

Popular Posts: 3 Biotech Stocks That Belong in Your PortfolioDrones – How to Cash In on Drone Stocks5 Battered Dividend Stocks to Buy Now Recent Posts: IBM Earnings Preview: 3 Clues to Watch for in Thursday's Report 3 Biotech Stocks That Belong in Your Portfolio 3 Takeaways from Amazon's Bid to Begin U.S. Drone Tests View All Posts IBM Earnings Preview: 3 Clues to Watch for in Thursday's Report

Popular Posts: 3 Biotech Stocks That Belong in Your PortfolioDrones – How to Cash In on Drone Stocks5 Battered Dividend Stocks to Buy Now Recent Posts: IBM Earnings Preview: 3 Clues to Watch for in Thursday's Report 3 Biotech Stocks That Belong in Your Portfolio 3 Takeaways from Amazon's Bid to Begin U.S. Drone Tests View All Posts IBM Earnings Preview: 3 Clues to Watch for in Thursday's Report  IBM earnings in the first quarter were $2.4 billion ($2.54 per share) on revenue of $22.5 billion — down markedly from the same quarter last year. Hardware sales dropped a whopping 23% — expected given the overall slowdown in lower-end servers used in datacenters. Emerging market sales declined significantly as well. Big Blue also took an $870 million hit on severance for workers that were laid off as part of the company's strategic realignment.

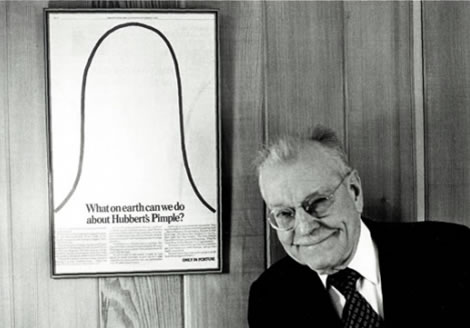

IBM earnings in the first quarter were $2.4 billion ($2.54 per share) on revenue of $22.5 billion — down markedly from the same quarter last year. Hardware sales dropped a whopping 23% — expected given the overall slowdown in lower-end servers used in datacenters. Emerging market sales declined significantly as well. Big Blue also took an $870 million hit on severance for workers that were laid off as part of the company's strategic realignment. Hubbert (shown at left), whose distinguished career also included stints as a senior research geophysicist for the United States Geological Survey and professorships at Stanford University and UC Berkeley, believed that oil production looked like a bell curve.

Hubbert (shown at left), whose distinguished career also included stints as a senior research geophysicist for the United States Geological Survey and professorships at Stanford University and UC Berkeley, believed that oil production looked like a bell curve. Elvis Barukcic, AFP/Getty ImagesTourists take a guided tour of medieval defense walls surrounding the historical city of Dubrovnik, Croatia. ZAGREB, Croatia -- The wildly popular "Game of Thrones" TV series has spurred tourists' interest in visiting Croatia, where much of the epic TV fantasy is set. But it could also help re-establish Croatia's reputation from Yugoslav days as a location for film making. "Thanks to 'Game of Thrones,' many people are coming to visit the very old walls in Dubrovnik and Split," Croatia's deputy tourism minister, Ratomir Ivicic told CNBC. "Season five will be made in Sibenik -- also a very beautiful place in Croatia." "Game of Thrones" grew its audience 24 percent last season, delivering viewer tallies on a par with the final episodes of hit series "The Sopranos." Filmed in different spots across Europe, "Game of Thrones" has inspired interest in places like Dubrovnik, an ancient Croat port city and UNESCO World Heritage Site used to represent King's Landing. Special "Game of Thrones" tours are now available in both Dubrovnik and Split for those want to relive the show. 'Winds of War' Several internationally renowned television programs and movies were shot in Croatia during the Yugoslav era. These included television miniseries "Winds of war" and "The pope must die," a comedy film starring Robbie Coltrane that was filmed just before the Croat Independence War erupted in 1991. While some film makers headed to the Yugoslav capital of Belgrade, most chose Croatia, the Republic's filming hub. The city of Zagreb appealed because its typically central European appearance meant it could pass for Vienna -- a more expensive place to shoot -- or Prague, which was cheap but trapped behind the Iron Curtain. Zagreb's large film studio remains to this day, but the carnage of the 1990s brought the industry to near-collapse. While some non-war-related filming continued in Zagreb, which was away from the frontline, most camera crews visited only to capture the violence. Croatia's film sector has yet to fully recover 20 years on, but has the chance to use the success of "Game of Thrones" to attract directors back. Local business leader Ivica Mudrinic was sanguine about Croatia's prospects of building on the attention.

Elvis Barukcic, AFP/Getty ImagesTourists take a guided tour of medieval defense walls surrounding the historical city of Dubrovnik, Croatia. ZAGREB, Croatia -- The wildly popular "Game of Thrones" TV series has spurred tourists' interest in visiting Croatia, where much of the epic TV fantasy is set. But it could also help re-establish Croatia's reputation from Yugoslav days as a location for film making. "Thanks to 'Game of Thrones,' many people are coming to visit the very old walls in Dubrovnik and Split," Croatia's deputy tourism minister, Ratomir Ivicic told CNBC. "Season five will be made in Sibenik -- also a very beautiful place in Croatia." "Game of Thrones" grew its audience 24 percent last season, delivering viewer tallies on a par with the final episodes of hit series "The Sopranos." Filmed in different spots across Europe, "Game of Thrones" has inspired interest in places like Dubrovnik, an ancient Croat port city and UNESCO World Heritage Site used to represent King's Landing. Special "Game of Thrones" tours are now available in both Dubrovnik and Split for those want to relive the show. 'Winds of War' Several internationally renowned television programs and movies were shot in Croatia during the Yugoslav era. These included television miniseries "Winds of war" and "The pope must die," a comedy film starring Robbie Coltrane that was filmed just before the Croat Independence War erupted in 1991. While some film makers headed to the Yugoslav capital of Belgrade, most chose Croatia, the Republic's filming hub. The city of Zagreb appealed because its typically central European appearance meant it could pass for Vienna -- a more expensive place to shoot -- or Prague, which was cheap but trapped behind the Iron Curtain. Zagreb's large film studio remains to this day, but the carnage of the 1990s brought the industry to near-collapse. While some non-war-related filming continued in Zagreb, which was away from the frontline, most camera crews visited only to capture the violence. Croatia's film sector has yet to fully recover 20 years on, but has the chance to use the success of "Game of Thrones" to attract directors back. Local business leader Ivica Mudrinic was sanguine about Croatia's prospects of building on the attention.

MORE GURUFOCUS LINKS

MORE GURUFOCUS LINKS  186.1 (1y: +83%) $(function(){var seriesOptions=[],yAxisOptions=[],name='BIDU',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1373864400000,101.59],[1373950800000,105.69],[1374037200000,108.53],[1374123600000,111.2],[1374210000000,111.08],[1374469200000,110.01],[1374555600000,109.84],[1374642000000,113.37],[1374728400000,125.85],[1374814800000,127.56],[1375074000000,129.33],[1375160400000,131.69],[1375246800000,132.31],[1375333200000,134.93],[1375419600000,139.699],[1375678800000,133.89],[1375765200000,134.56],[1375851600000,135.33],[1375938000000,135.74],[1376024400000,138.19],[1376283600000,136.73],[1376370000000,141.53],[1376456400000,138.51],[1376542800000,134.92],[1376629200000,134.64],[1376888400000,135.01],[1376974800000,134.96],[1377061200000,135.99],[1377147600000,139.54],[1377234000000,138.64],[1377493200000,139.02],[1377579600000,135.122],[1377666000000,138.98],[1377752400000,139.76],[1377838800000,135.53],[1378184400000,136.17],[1378270800000,134.49],[1378357200000,132.99],[1378443600000,135.67],[1378702800000,136.58],[1378789200000,140.6],[1378875600000,147.31],[1378962000000,144.5],[1379048400000,142.64],[1379307600000,142.59],[1379394000000,143.805],[1379480400000,145.7],[1379566800000,147.7],[1379653200000,146.25],[1379912400000,149.26],[1379998800000,150.13],[1380085200000,150.68],[1380171600000,154.28],[1380258000000,153.84],[1380517200000,155.18],[1380603600000,158.64],[1380690000000,159.94],[1380776400000,157.08],[1380862800000,159],[1381122000000,157.54],[1381208400000,148.75],[1381294800000,146.54],[1381381200000,153.16],[1381467600000,154.9],[1381726800000,152.96],[1381813200000,151.5],[1381899600000,150.2],[1381986000000,153.83],[1382072400000,165.91],[1382331600000,161.21],[1382418000000,158.57],[1382504400000,155.07],[1382590800000,161.34],[1382677200000,159.36],[1382936400000,154.12],[1383022800000,159.41],[1383109200000,164.934],[1383195600000,160.799],[1383282000000,160.06],[1383544800000,156.02],[1383631200000,153.462],[1383717600000,150.09],[1383804000000,147.35],[1383! 890400000,151.09],[1384149600000,151.6],[1384236000000,150.43],[1384322400000,152.98],[1384408800000,158.99],[1384495200000,162.33],[1384754400000,162.87],[1384840800000,163.12],[1384927200000,158.76],[1385013600000,158.404],[1385100000000,158.09],[1385359200000,156.66],[1385445600000,163.03],[1385532000000,162.99],[1385704800000,166.57],[1385964000000,168.66],[1386050400000,167.05],[1386136800000,168.26],[1386223200000,167.36],[1386309600000,168.71],[1386568800000,171.899],[1386655200000,179.93],[1386741600000,173.24],[1386828000000,171.5],[1386914400000,171.24],[1387173600000,169.01],[1387260000000,168.33],[1387346400000,171.49],[1387432800000,170.39],[1387519200000,173.36],[1387778400000,172.3],[1387864800000,168.578],[1388037600000,167.28],[1388124000000,173.77],[1388383200000,173.99],[1388469600000,177.88],[1388642400000,179.99],[1388728800000,175.28],[1388988000000,176.63],[1389074400000,178.82],[1389160800000,181.79],[1389247200000,175.52],[1389333600000,179.66],[1389592800000,171],[1389679200000,172.87],[1389765600000,170.5],[1389852000000,173],[1389938400000,170.14],[1390284000000,172.7],[1390370400000,174.43],[1390456800000,163.58],[1390543200000,161.37],[1390802400000,158.68],[1390888800000,164.24],[1390975200000,158.1],[1391061600000,160.

186.1 (1y: +83%) $(function(){var seriesOptions=[],yAxisOptions=[],name='BIDU',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1373864400000,101.59],[1373950800000,105.69],[1374037200000,108.53],[1374123600000,111.2],[1374210000000,111.08],[1374469200000,110.01],[1374555600000,109.84],[1374642000000,113.37],[1374728400000,125.85],[1374814800000,127.56],[1375074000000,129.33],[1375160400000,131.69],[1375246800000,132.31],[1375333200000,134.93],[1375419600000,139.699],[1375678800000,133.89],[1375765200000,134.56],[1375851600000,135.33],[1375938000000,135.74],[1376024400000,138.19],[1376283600000,136.73],[1376370000000,141.53],[1376456400000,138.51],[1376542800000,134.92],[1376629200000,134.64],[1376888400000,135.01],[1376974800000,134.96],[1377061200000,135.99],[1377147600000,139.54],[1377234000000,138.64],[1377493200000,139.02],[1377579600000,135.122],[1377666000000,138.98],[1377752400000,139.76],[1377838800000,135.53],[1378184400000,136.17],[1378270800000,134.49],[1378357200000,132.99],[1378443600000,135.67],[1378702800000,136.58],[1378789200000,140.6],[1378875600000,147.31],[1378962000000,144.5],[1379048400000,142.64],[1379307600000,142.59],[1379394000000,143.805],[1379480400000,145.7],[1379566800000,147.7],[1379653200000,146.25],[1379912400000,149.26],[1379998800000,150.13],[1380085200000,150.68],[1380171600000,154.28],[1380258000000,153.84],[1380517200000,155.18],[1380603600000,158.64],[1380690000000,159.94],[1380776400000,157.08],[1380862800000,159],[1381122000000,157.54],[1381208400000,148.75],[1381294800000,146.54],[1381381200000,153.16],[1381467600000,154.9],[1381726800000,152.96],[1381813200000,151.5],[1381899600000,150.2],[1381986000000,153.83],[1382072400000,165.91],[1382331600000,161.21],[1382418000000,158.57],[1382504400000,155.07],[1382590800000,161.34],[1382677200000,159.36],[1382936400000,154.12],[1383022800000,159.41],[1383109200000,164.934],[1383195600000,160.799],[1383282000000,160.06],[1383544800000,156.02],[1383631200000,153.462],[1383717600000,150.09],[1383804000000,147.35],[1383! 890400000,151.09],[1384149600000,151.6],[1384236000000,150.43],[1384322400000,152.98],[1384408800000,158.99],[1384495200000,162.33],[1384754400000,162.87],[1384840800000,163.12],[1384927200000,158.76],[1385013600000,158.404],[1385100000000,158.09],[1385359200000,156.66],[1385445600000,163.03],[1385532000000,162.99],[1385704800000,166.57],[1385964000000,168.66],[1386050400000,167.05],[1386136800000,168.26],[1386223200000,167.36],[1386309600000,168.71],[1386568800000,171.899],[1386655200000,179.93],[1386741600000,173.24],[1386828000000,171.5],[1386914400000,171.24],[1387173600000,169.01],[1387260000000,168.33],[1387346400000,171.49],[1387432800000,170.39],[1387519200000,173.36],[1387778400000,172.3],[1387864800000,168.578],[1388037600000,167.28],[1388124000000,173.77],[1388383200000,173.99],[1388469600000,177.88],[1388642400000,179.99],[1388728800000,175.28],[1388988000000,176.63],[1389074400000,178.82],[1389160800000,181.79],[1389247200000,175.52],[1389333600000,179.66],[1389592800000,171],[1389679200000,172.87],[1389765600000,170.5],[1389852000000,173],[1389938400000,170.14],[1390284000000,172.7],[1390370400000,174.43],[1390456800000,163.58],[1390543200000,161.37],[1390802400000,158.68],[1390888800000,164.24],[1390975200000,158.1],[1391061600000,160.

Older pre-retirees are furthest from being retirement-ready, according to a recent analysis by BlackRock and the Employee Benefit Research Institute.

Older pre-retirees are furthest from being retirement-ready, according to a recent analysis by BlackRock and the Employee Benefit Research Institute.

Popular Posts: 5 Oil Services Stocks to Play Rising SpendingBe Wary of These 3 New MLP ETFs3 Healthcare Stocks for Retirement Investors Recent Posts: Now Is the Perfect Time to Buy Refining Stocks Is the Sun Fading on ETFs? – Morning Linkfest (July 7) Happy Birthday, 'Murica … And New Stocks – Morning Linkfest (July 3) View All Posts Now Is the Perfect Time to Buy Refining Stocks

Popular Posts: 5 Oil Services Stocks to Play Rising SpendingBe Wary of These 3 New MLP ETFs3 Healthcare Stocks for Retirement Investors Recent Posts: Now Is the Perfect Time to Buy Refining Stocks Is the Sun Fading on ETFs? – Morning Linkfest (July 7) Happy Birthday, 'Murica … And New Stocks – Morning Linkfest (July 3) View All Posts Now Is the Perfect Time to Buy Refining Stocks

Google has received more than 70,000 requests from individuals who want articles removed from its European search results. LONDON (CNNMoney) Google has started deleting some news articles in Europe to comply with a recent court ruling, sparking criticism that it is restricting freedom of speech.

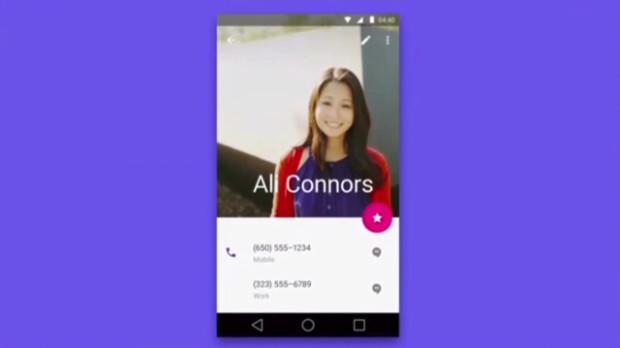

Google has received more than 70,000 requests from individuals who want articles removed from its European search results. LONDON (CNNMoney) Google has started deleting some news articles in Europe to comply with a recent court ruling, sparking criticism that it is restricting freedom of speech.  Check out Google's new Android L

Check out Google's new Android L

Did Facebook study go too far? NEW YORK (CNNMoney) Facebook can't seem to bring itself to apologize for performing psychological experiments on its users.

Did Facebook study go too far? NEW YORK (CNNMoney) Facebook can't seem to bring itself to apologize for performing psychological experiments on its users.  Facebook's controversial mood experiment

Facebook's controversial mood experiment