LONDON -- One of�Warren Buffett's famous investing sayings is "be fearful when others are greedy and greedy only when others are fearful" -- or, in other words, sell when others are buying and buy when they're selling.

But we might expect Foolish investors to know that, and looking at what Fools have been buying recently might well provide us with some ideas for good investments.�

So, in this series of articles, we're going to look at what customers of The Motley Fool ShareDealing Service have been buying in the past week or so, and what might have made them decide to do so.

Triple-whammy

The share price of�FirstGroup� (LSE: FGP ) -- the bus and rail operator -- has plunged over 40% in the past couple of weeks, following a triple-whammy announcement of a rights issue, a dividend cut and a profit warning in its preliminary final results, and the loss of chairman Martin Gilbert, who agreed to stand down once a successor has been found.

The cash-call was necessary to avert a potential downgrading of debt-laden FirstGroup's credit rating to "junk status", which could have forced up interest rates on its existing debt, and also caused serious problems, or even disqualification, when bidding for things like rail franchises.

Hot Warren Buffett Stocks To Buy For 2014: Encounter Resources Ltd (ENR.AX)

Encounter Resources Ltd. engages in the exploration and development of mineral properties in western Australia. The company explores for uranium; manganese; and base metals, such as copper, silver, lead, and zinc. It primary focuses on the Yeneena project covering 1,300 square kilometers located in the Paterson Province of western Australia. Encounter Resources Ltd. was founded in 2004 and is based in West Perth, Australia.

Hot Warren Buffett Stocks To Buy For 2014: Nuveen Insured California Premium Income Municipal Fund II In (NCL)

Norwegian Cruise Line Holdings Ltd., through its subsidiaries, operates as a cruise line operator, offering cruise experiences for travelers with various itineraries in North America, the Mediterranean, the Baltic, Central America, Bermuda, and the Caribbean. The company offers cruises ranging in length from 1 day to 3 weeks. As of December 31, 2012, it operated 11 ships offering cruises in Alaska, the Bahamas, Bermuda, the Caribbean, Europe, Hawaii, Mexico, New England, Central and South America, North Africa, and Scandinavia. The company was formerly known as NCL Corporation Ltd. and changed its name on January 24, 2013. Norwegian Cruise Line Holdings Ltd. was founded in 1966 and is headquartered in Miami, Florida.

Advisors' Opinion: - [By Rick Munarriz]

Carnival stock is trading closer to its 52-week low than its high, and the same can't be said of rivals Royal Caribbean (NYSE: RCL ) and NCL (NYSE: NCL ) .�

- [By Rick Munarriz]

Royal Caribbean,�NCL (NYSE: NCL ) , and ship spa services provider Steiner Leisure (NASDAQ: STNR ) all hit new 52-week highs earlier this month. Unlike Carnival (NYSE: CCL ) -- which has been sluggish in light of several mishaps at sea since last year -- everyone seemed to view the negative instances as Carnival-specific events. Now Royal Caribbean's fire may lead folks to question booking on any cruise line in the near future.

Pirelli & C. Real Estate S.p.A. is a real estate arm of Pirelli & C. S.p.a. The firm engages in investment, development, and management of properties. It invests in the real estate markets of Italy, Germany, and Poland. The firm?s portfolio includes both commercial and residential properties. Pirelli & C. Real Estate S.p.A. is based in Milan, Italy. Prelios SpA (CM:PRS) operates independently of Pirelli & C. SpA as of October 21, 2010.

Hot Warren Buffett Stocks To Buy For 2014: Cost Plus Inc.(CPWM)

Cost Plus, Inc. operates as a specialty retailer of casual home furnishings and entertaining products in the United States. It offers home decorating items that include furniture, rugs, pillows, bath linens, lamps, window coverings, frames, and baskets; and furniture products, which comprise ready-to-assemble living and dining room pieces, handcrafted case goods, occasional pieces, and outdoor furniture made from various materials, such as rattan, hardwood, and metal. The company also provides tabletop and kitchen items, including glassware, ceramics, textiles, and cooking utensils; gift and decorative accessories comprising collectibles, candles, framed art, and holiday and other seasonal items; and jewelry, fashion accessories, and personal care items. In addition, it offers gourmet foods and beverages, including wine, microbrewed and imported beer, coffee, tea, and bottled water. The company operates stores under the names of World Market, Cost Plus World Market, Cost P lus Imports, and World Market Stores. Cost Plus, Inc. also sells its products through its Web site, worldmarket.com. As of May 19, 2011, it operated 259 stores in 30 states. The company was founded in 1946 and is headquartered in Oakland, California.

Hot Warren Buffett Stocks To Buy For 2014: Fortress Investment Group LLC (FIG)

Fortress Investment Group LLC (Fortress) is a global investment management firm. Its offering of alternative investment products includes private equity funds, liquid hedge funds and credit funds. In addition, it offers traditional investment products. As of December 31, 2011, it managed alternative assets in three businesses: Private Equity, Liquid Hedge Funds and Credit Funds. Private Equity is a business, which manages assets under management (AUM) consisted of two business segments: private equity funds, which make investments in debt and equity securities of public or privately held entities in North America and Western Europe, and publicly traded alternative investment vehicles, which it refer to as Castles, which invest in real estate and real estate related debt investments. Liquid Hedge Funds invest globally in fixed income, currency, equity and commodity markets and related derivatives. Credit Funds is a business, which manages AUM consisted of two business segments: credit hedge funds which make investments in assets, opportunistic lending situations and securities, on a global basis and throughout the capital structure, as well as non-Fortress originated funds, for which Fortress has been retained as manager as part of an advisory business, and credit private equity (PE) funds, which are consisted of a family of credit opportunities funds focused on investing in distressed and undervalued assets, a range of long dated value funds focused on investing in undervalued assets with cash flows and long investment horizons, a range of real assets funds focused on investing in tangible and intangible assets in four principal categories (real estate, capital assets and natural resources), a family of Asia funds, including Japan real estate funds and an Asian investor based global opportunities fund, and a range of real estate opportunities funds.

Private Equity Funds

The Company�� private equity business is made up of a series of funds named the Fortress Investment Funds! and organized to make control-oriented investments in cash flow generating, asset-based businesses in North America and Western Europe. Investors in its private equity funds contractually commit capital at the outset of a fund, which is then drawn down as investment opportunities become available, generally over a one to three year investment period. Management fees of 1% to 1.5% are generally charged on committed capital during the investment period of a new fund, and then on invested capital (or net asset value (NAV), if lower). It also earns a 10% to 25% share of the profits on each realized investment in a fund.

The Company manages two companies: Newcastle Investment Corp. and Eurocastle Investment Limited, which it calls its Castles. It earns management fees from each Castle equal to 1.5% of the company�� equity. In addition, it earns incentive income equal to 25% of the company�� funds from operations (FFO) in excess of specified returns to the Company�� shareholders. In addition to these fees, it also receives from the Castles, for services provided, options to purchase shares of their common stock in connection with each of their common stock offerings.

Liquid Hedge Funds

The Fortress Macro Funds, and Fortress�� legacy macro-strategy funds, the Drawbridge Global Macro Funds, apply an investment process based on macroeconomic fundamental, market momentum and technical analyses. The funds have the flexibility to allocate capital dynamically across a range of global strategies, markets and instruments as opportunities change, and are designed to take advantage of a range of sources of market, economic and pricing data to generate trading ideas. The fund invests in developed markets; they also invest in emerging markets if market conditions present opportunities for attractive returns. The funds pursue global macro directional and relative value strategies. Management fees are charged based on the AUM of the Fortress Macro Funds at a rate between 1.5%! and 2% a! nnually, depending on the investment and liquidity terms elected by investors. It earns incentive income of between 15% and 25% of the fund�� profits, generally payable annually, depending on the investment and liquidity terms elected by investors. In other words, an incentive income payment establishes a high water mark, such that the fund must earn a cumulative positive return from that point forward in order for Fortress to earn incentive income. Investors in the Fortress Macro Funds may invest with the right to redeem without paying any redemption fee either monthly, quarterly, or annually after three years. Investors with three-year liquidity may redeem annually before three years, subject to an early redemption fee payable to the funds.

The Fortress Asia Macro Funds invest in global fixed income, commodities, currency and equity markets, and their related derivatives, thematically related to the Asia-Pacific region through a fundamental macroeconomic strategy, which focuses on liquid investments. The funds��investment program focuses on global trading and capital flows. Management fee rates for these funds range from 1.5% to 2% and it earns incentive income equal to 20% of their profits. Commodities Funds invests across multiple sectors within the commodity asset class ranging from energy to metals to agriculture and within the cyclical, industrial, and commodity equity universe. Management fee rates for these funds range from 1.5% to 2% and it earns incentive income equal to 20% of their profits. The Fortress Partners Fund�� investments are made both in Fortress Funds and in funds managed by other managers, and in direct investments that are sourced either by Fortress personnel or by third parties with whom it has relationships. Management fee rates for these funds range from 1% to 1.5% and it earns incentive income generally equal to 20% of the profits from direct investments only.

Credit Funds

The Company�� credit hedge funds are designed to exploi! t pricing! anomalies, which exist between the public and private finance markets. It has developed a network consisted of internal and external resources to source transactions for the funds. The funds are able to invest in a range of financial instruments, ranging from assets, opportunistic lending situations and securities throughout the capital structure with a value orientation.

The Drawbridge Special Opportunities Funds form the core of the Company�� credit hedge fund investing strategy. The funds acquire a portfolio of investments throughout the United States, Western Europe and the Pacific region. Management fees are charged based on the AUM of the Drawbridge Special Opportunities Funds at a rate generally equal to 2% annually. It earns incentive income of 20% of the fund�� profits, payable annually, and subject to achieving cumulative positive returns since the prior incentive income payment. Investors in the Drawbridge Special Opportunities Funds may redeem annually on December 31. The Worden Funds invest in a portfolio of undervalued and distressed investments in North America and Western Europe, but also in Australia, Asia and elsewhere on an opportunistic basis. Management fees are charged based on the AUM of the Worden Funds at a rate generally equal to 2% annually. It earns incentive income of 20% of the funds��profits.

The Company�� credit PE funds are of families of funds. They have management fee rates between 1% and 1.5% and generate incentive income of between 10% and 20% of a fund�� profits subject to the fund achieving a minimum return as a whole. Fortress through Fortress Credit Opportunities Funds make opportunistic credit-related investments. In addition to its Fortress Investment Fund family of funds, it has a private equity fund product, the Long Dated Value family of funds, which focuses on making investments with long dated cash flows. Its Real Assets Funds invest in tangible and intangible assets. The investment program of these funds focuses on di! rect inve! stments in four principal investment categories: real estate, capital assets and natural resources, but also may include indirect investments in the form of interests in real estate investment trusts (REITs), master limited partnerships, corporate securities, debt securities and debt obligations, including those that provide equity upside, as well as options, royalties, residuals and other call rights. The investments are located in North America and Western Europe. Fortress Japan Opportunity Funds focus to invest in Japanese real estate-related performing, sub-performing and non-performing loans, securities and similar instruments. Real Estate Opportunities Funds make opportunistic commercial real estate investments.

Advisors' Opinion: - [By Inyoung Hwang]

He currently has buy recommendations on private-equity firm Fortress Investment Group LLC (FIG) and Zions Bancorporation. (ZION)

Analysts Surveyed To compile the ranking, Stamford, Connecticut-based Greenwich Associates surveyed 945 buy-side analysts at 190 investment management firms, mutual funds, hedge funds, pension funds and insurers from December to March. The analysts were asked to name the Wall Street research teams they considered their most important sources of advice on investments.

- [By Dakin Campbell]

Servicing rights on at least $1 trillion of mortgages will trade in the next two years, Jay Bray, chief executive officer of Nationstar Mortgage Holdings Inc. (NSM), a servicer majority owned by Fortress Investment Group LLC (FIG), said last month. The private-equity firm said in July it raised a $1.1 billion fund to buy the contracts.

- [By Amanda Alix]

This turn of events worked in favor of Fortress Investment Group's (NYSE: FIG ) portfolio, which held the former Centex Corp, the subprime mortgage lending unit of a Texas homebuilder. That company is now Nationstar, which is definitely doing its fair share to add to its parent's bottom line. Also owned by Fortress is Newcastle Investment (NYSE: NCT ) , the diversified REIT with an involvement in almost anything to do with real estate, whether residential or commercial.

Hot Warren Buffett Stocks To Buy For 2014: Intl Parkside Products Inc.(IPD.V)

International Parkside Products Inc., through its subsidiaries, engages in the production and marketing of optical and screen cleaning products. Its products include various photo and optic lens cleaning devices, such as Lenspen, Lenspen MiniPRO II, Lenspen CellKlear, Lenspen DigiKlear, ProPak I, ProPak II, Camouflage LensPen, Anti-Fog Solution, MicroPro, MobileKlear Kit, FogKlear, Hurricane Blower, OutDoorPro Kit, PhotoPro Kit, SensorKlear Loupe, SensorKlear II, SensorKlear Loupe kit, FilterKlear, TriKlear, DSLR Pro Kit, SensorKlear II Plus, Mini-Pro, and Mini-Pro II, as well as HunterPro Kits, Photo Kits, RangeKlear, Screencleaning Kits, and Microfiber cloth. The company also provides universal screen cleaners comprising Lenspen MicroKlear, LapTop Pro, Lenspen VidiMax, Screen Cleaning Kit, VidiMax Ultra Kit, LapTop-Pro Ultra Kit, NavKlear, ScreenKlean, and replacement cleaning pads for SideKick and LapTop-Pro. In addition, it offers accessories, such as Panamatic, SideKi ck, and SensorKlear Loupe Kit. The company sells its products primarily in North America, Europe, Asia, Russia, and Latin America. International Parkside Products Inc. was incorporated in 1983 and is headquartered in Vancouver, Canada.

Popular Posts: 5 Fire-Breathing China Mutual Funds to BuyThe Gun Stocks Trade Is Still FiringForget Amazon and eBay — China Has the Hottest Online Retailers Recent Posts: The Gun Stocks Trade Is Still Firing SSO — Double Down When D.C.’s Squabbles Die Down 5 Fire-Breathing China Mutual Funds to Buy View All Posts

Popular Posts: 5 Fire-Breathing China Mutual Funds to BuyThe Gun Stocks Trade Is Still FiringForget Amazon and eBay — China Has the Hottest Online Retailers Recent Posts: The Gun Stocks Trade Is Still Firing SSO — Double Down When D.C.’s Squabbles Die Down 5 Fire-Breathing China Mutual Funds to Buy View All Posts

).

).

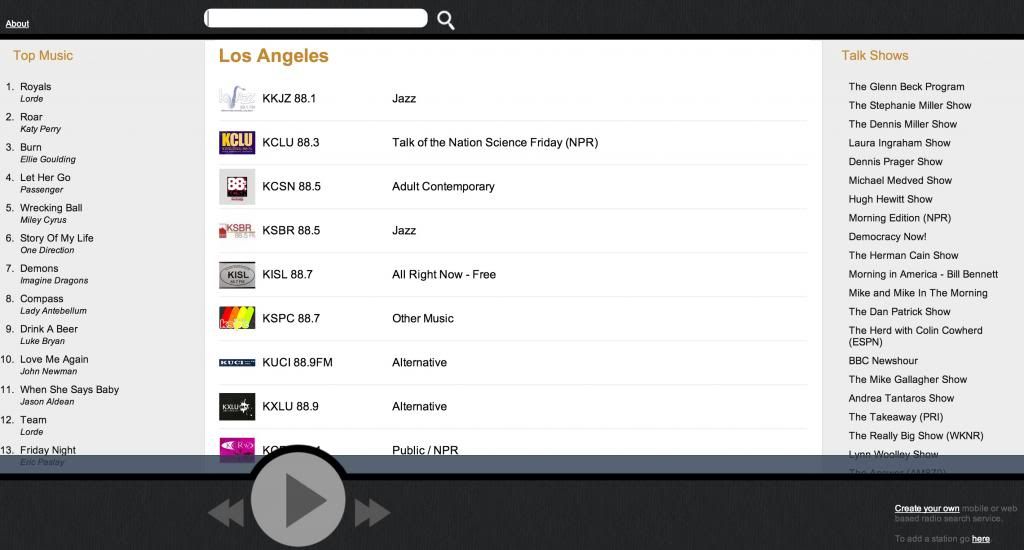

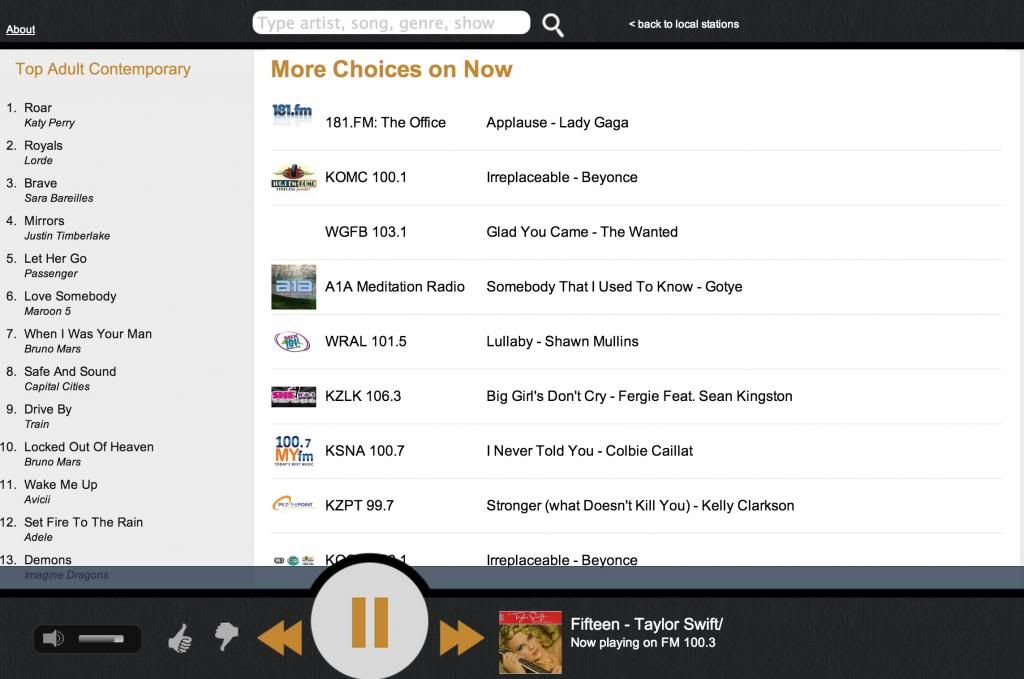

It's that simple. Search for a song or a program and the Radio Search Engine spits out all the places -- Internet and broadcast radio streaming online -- where you can find what you're looking for, along with recommendations for other things you might like. Simple, but brilliant. And clearly beyond the limited capacities of so many of the cats in broadcast radio who refuse to admit they're losing. It's even cooler for a radio geek like me, who spent the days and nights of his childhood struggling to sample stations from across the country. Streaming changed that. And this search engine takes things to an entirely new, dynamic and way more convenient level. You can play with the Radio Search Engine yourself HERE. Follow @rocco_thestreet --Written by Rocco Pendola in Santa Monica, Calif.

It's that simple. Search for a song or a program and the Radio Search Engine spits out all the places -- Internet and broadcast radio streaming online -- where you can find what you're looking for, along with recommendations for other things you might like. Simple, but brilliant. And clearly beyond the limited capacities of so many of the cats in broadcast radio who refuse to admit they're losing. It's even cooler for a radio geek like me, who spent the days and nights of his childhood struggling to sample stations from across the country. Streaming changed that. And this search engine takes things to an entirely new, dynamic and way more convenient level. You can play with the Radio Search Engine yourself HERE. Follow @rocco_thestreet --Written by Rocco Pendola in Santa Monica, Calif.