DELAFIELD, Wis. (Stockpickr) -- There isn't a day that goes by on Wall Street when certain stocks trading for $10 a share or less don't experience massive spikes higher. Traders savvy enough to follow the low-priced names and trade them with discipline and sound risk management are banking ridiculous coin on a regular basis.

>>5 Big Trades to Take in February

Just take a look at some of the hot movers in the under-$10 complex from Thursday, including Prima Biomed (PBMD), which is skyrocketing higher by 47%; Glu Mobile (GLUU), which is soaring higher by 24%; Monster Worldwide (MWW), which is ripping higher by 22%; and RealD (RLD), which is spiking higher by 13%. You don't even have to catch the entire move in lower-priced stocks such as these to make outsized returns when trading.

One low-priced stock that recently soared sharply higher after I featured it was China-based medical components player Dehaier Medical Systems (DHRM), which I highlighted in Jan. 16's "5 Stocks Under $10 Set to Soar" at around $4.75 per share. I mentioned in that piece that shares of Dehaier Medical Systems had been uptrending strong recently, with the stock moving higher from its low of $2 a share to its high of $4.80 a share. During that move, shares of DHRM were consistently making higher lows and higher highs, which is bullish technical price action. That move had pushed shares of DHRM within range of triggering a major breakout trade above some near-term overhead resistance levels at $4.80 to $4.85 a share.

>>5 Low-Priced Stocks to Trade for Gains

Guess what happened? Shares of Dehaier Medical Systems didn't wait long to trigger that breakout, since the stock started to bust above those key resistance levels the same day my article was published was heavy upside volume. This stock has continued to soar higher since taking out those levels, with shares tagging an intraday high today of $6.36 a share. That represents a monster gain of close to 40% in just a few weeks for anyone who went long DHRM into the breakout strength. You can see here how a low-priced stock can make a monster move once it clears key resistance levels with high volume.

Low-priced stocks are something that I tweet about on a regular basis. I frequently flag high-probability setups, breakout candidates and low-priced stocks that are acting technically bullish. I like to hunt for low-priced stocks that are showing bullish price and volume trends, since that increases the probability of those stocks heading higher. These setups often produce monster moves higher in very short time frames.

I'm not as eager to recommend investing long-term in stocks that trade less than $10 a share because these names can be very speculative, and the odds for picking the long-term winners aren't great. But I definitely love to trade stocks that are priced below $10. I like to view them as a trading vehicle with lots of volatility and lots of upside when the trade is timed right.

>>3 Stocks Breaking Out on Unusual Volume

When I trade under-$10 names, I do it almost entirely based off of the charts and technical analysis. I also like to find under-$10 names with a catalyst, but that's secondary to the chart and volume patterns.

With that in mind, here's a look at several under-$10 stocks that look poised to potentially trade higher from current levels.

Acasti Pharma

One under-$10 biotechnology player that's starting to move within range of triggering a major breakout trade is Acasti Pharma (ACST), which focuses on the research, development and commercialization of new therapies for abnormalities in blood lipids, and the treatment and prevention of cardiovascular disorders. This stock has been destroyed by the bears over the last six months, with shares down sharply by 67%.

>>4 Big Stocks on Traders' Radars

If you take a look at the chart for Acasti Pharma, you'll notice that this stock has been consolidating and trending sideways for the last two months, with shares moving between $1.09 on the downside and $1.56 a share on the upside. This stock is starting to spike higher today and flirt with its 50-day moving average of $1.27 a share. That spike is quickly pushing shares of ACST within range of triggering a major breakout trade above the upper-end of its recent sideways trading chart pattern.

Traders should now look for long-biased trades in ACST if it manages to break out above some near-term overhead resistance levels at $1.32 a share and then once it clears more resistance at $1.54 to $1.56 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average volume of 425,658 shares. If that breakout triggers soon, then ACST will set up to re-test or possibly take out its next major overhead resistance levels at $2 to $2.20, or even its 200-day moving average at $2.31 a share.

Traders can look to buy ACST off any weakness to anticipate that breakout and simply use a stop that sits right below some key near-term support levels at $1.20 to $1.17 a share, or down near $1.10 a share. One can also buy ACST off strength once it starts to take out those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Recon Technology

Another under-$10 energy player that's starting to trend within range of triggering a major breakout trade is Recon Technology (RCON), which provides hardware, software and on-site services to companies in the petroleum mining and extraction industry in the People's Republic of China. This stock is off to a blazing start in 2014, with shares up sharply by 49%.

>>5 Stocks Insiders Love Right Now

If you take a look at the chart for Recon Technology, you'll notice that this stock has been uptrending very strong over the last two months, with shares soaring higher from its low of $2.84 to its recent high of $5.06 a share. During that uptrend, shares of RCON have been consistently making higher lows and higher highs, which is bullish technical price action. This stock also recently crossed back above its 50-day moving average, which is bullish technical price action. Shares of RCON are now starting to trend within range of triggering a major breakout trade above some key overhead resistance levels.

Market players should now look for long-biased trades in RCON if it manages to break out above some near-term overhead resistance levels at $4.75 to $5.06 a share and then once it clears its 52-week high at $5.80 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 178,784 shares. If that breakout hits soon, then RCON will set up to enter new 52-week-high territory, which is bullish technical price action. Some possible upside targets off that breakout are $8 to $10 a share.

Traders can look to buy RCON off any weakness to anticipate that breakout and simply use a stop that sits right around some key near-term support at $4 or at its 50-day moving average of $3.59 a share. One can also buy RCON off strength once it starts to clear those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Zogenix

One under-$10 health care player that's starting to trend within range of triggering a big breakout trade is Zogenix (ZGNX), which engages in the development and commercialization of products for the treatment of central nervous system disorders and pain. This stock has been exploding higher over the last six months, with shares up sharply by 170%.

>>3 Stocks Spiking on Big Volume

If you take a look at the chart for Zogenix, you'll notice that this stock has been uptrending strong for the last six months, with shares moving higher from its low of $1.50 to its recent high of $4.65 a share. During that uptrend, shares of ZGNX have been consistently making higher lows and higher highs, which is bullish technical price action. That move has now pushed shares of ZGNX within range of triggering a big breakout trade above some key near-term overhead resistance levels.

Traders should now look for long-biased trades in ZGNX if it manages to break out above some near-term overhead resistance levels at $4.50 to $4.55 a share and then once it takes out its 52-week high a $4.65 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average volume of 2.44 million shares. If that breakout triggers soon, then ZGNX will set up to enter new 52-week-high territory, which is bullish technical price action. Some possible upside targets off that breakout are $6 to $7 a share.

Traders can look to buy ZGNX off weakness to anticipate that breakout and simply use a stop that sits just below its 50-day moving average at $3.66 a share, or around more support at $3.25 a share. One can also buy ZGNX off strength once it starts to take out those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Rexahn Pharmaceuticals

Another under-$10 biotechnology player that's quickly moving within range of triggering a major breakout trade is Rexahn Pharmaceuticals (RNN), which engages in the discovery, development and commercialization of treatments for cancer, central nervous system disorders, sexual dysfunction, and other medical needs. This stock is off to an explosive start in 2014, with shares up a whopping 119%.

>>5 Ways to Invest Like a Pension Fund

If you take a look at the chart for Rexahn Pharmaceuticals, you'll notice that this stock has been consolidating and trending sideways over the last month, with shares moving between 86 cents per share on the downside and $1.24 a share on the upside. Shares of RNN are starting to spike higher today right off some near-term support at $1 a share. That spike is quickly pushing shares of RNN within range of triggering a major breakout trade above the upper-end of its recent sideways trading chart pattern.

Market players should now look for long-biased trades in RNN if it manages to break out above some near-term overhead resistance levels at $1.20 to $1.24 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 7.79 million shares. If that breakout hits soon, then RNN will set up to re-test or possibly take out its next major overhead resistance levels at $1.60 to its 52-week high at $1.85 a share. Any high-volume move above those levels will then give RNN a chance to tag $2 to $2.20 a share.

Traders can look to buy RNN off weakness to anticipate that breakout and simply use a stop that sits just below some key near-term supports at $1 to 86 cents per share. One can also buy RNN off strength once it starts to clear those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Verso Paper

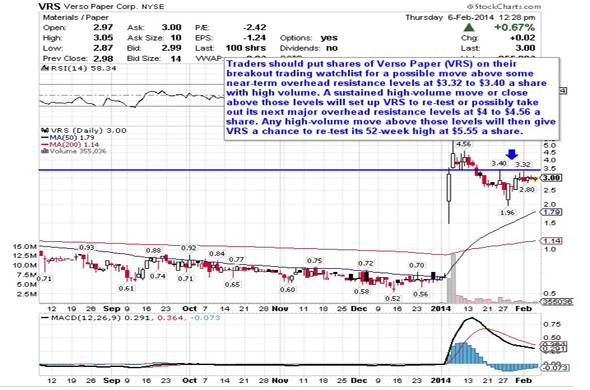

One final under-$10 basic materials player that's starting to trend within range of triggering a big breakout trade is Verso Paper (VRS), which engages in the production and sale of coated papers in the U.S. This stock is off to a monster start in 2014, with shares up a ridiculous amount of 371%.

If you take a look at the chart for Verso Paper, you'll notice that this stock has recently pulled back from its high of $5.55 a share to its low of $1.96 a share. During that sharp fall, shares of VRS have been consistently making lower highs and lower lows, which is bearish technical price action. That said, shares of VRS have now started to rebound sharply off that $1.96 low and the stock is starting to push within range of triggering a big breakout trade.

Traders should now look for long-biased trades in VRS if it manages to break out above some near-term overhead resistance levels at $3.32 to $3.40 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 608,131 shares. If that breakout hits soon, then VRS will set up to re-test or possibly take out its next major overhead resistance levels at $4 to $4.56 a share. Any high-volume move above those levels will then give VRS a chance to re-test its 52-week high at $5.55 a share.

Traders can look to buy VRS off weakness to anticipate that breakout and simply use a stop that sits right below some key near-term support levels at $2.80 or at $2.50 a share. One can also buy VRS off strength once it starts to take out those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

To see more hot under-$10 equities, check out the Stocks Under $10 Setting Up to Explode portfolio on Stockpickr.

-- Written by Roberto Pedone in Delafield, Wis.

RELATED LINKS:

>>5 Rocket Stocks to Buy in February

>>Where's the S&P Headed From Here? Higher!

>>4 Tech Stocks Spiking on Big Volume

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Roberto Pedone, based out of Delafield, Wis., is an independent trader who focuses on technical analysis for small- and large-cap stocks, options, futures, commodities and currencies. Roberto studied international business at the Milwaukee School of Engineering, and he spent a year overseas studying business in Lubeck, Germany. His work has appeared on financial outlets including

CNBC.com and Forbes.com. You can follow Pedone on Twitter at www.twitter.com/zerosum24 or @zerosum24.

No comments :

Post a Comment