This past week marked my six-month anniversary of focusing on a space that I didn't even realize existed until I read a sensational article about one of the leading companies in the sector that marked the popping of a bubble that I then described in "Reefer Madness: Pot Stocks In A Bubble". Since then, I have published several articles on the sector as I have come up the learning curve. You can access the complete chronologically-ordered series here.

After intensive study, it's clear to me that the move towards legalized recreational and medical marijuana is likely to be a persistent and powerful investment theme over the next several years, and I am launching a series of articles intended to help investors navigate the space of the publicly-traded stocks. My goal is to help investors uncover opportunities but also, perhaps more importantly, to identify risks. I hope to balance my own perspective as a non-using financial analyst with input from experts. I have had many conversations with dispensary owners and others involved in the field and, in fact, am currently working on an interview that I intend to publish in the next week.

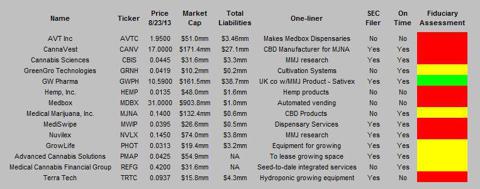

Today, I will be sharing my perspective on the sector, introducing a table to help investors quickly hone in on some important attributes of stocks in the marijuana-related company universe, sharing my "Focus Four" and introducing my first two "Cannabis Calls" on two of the leading names in the sector.

State of the Sector

Depending upon when one wants to start one's analysis, the pot stocks are either in a bear market or a correction of a bull market. The volatility has been tremendous since the elections in November, with a huge run followed by a big collapse. I think that potential investors need to realize several points:

Demand currently outstrips supply substantiallySupply is increasingThe quality of the companies is generally lowThere is minimal Wall Street coverage or participationAs I have previously described, the total market ! cap at present is not that much, as one can see in the table below. The public companies that claim to be participants in the cannabis sector represent a tiny fraction of the entire industry. While private investing may be a better option, it's not really available to most investors. In my view, the wave of interest and the lack of supply earlier this year led to significant imbalances. Currently, my read is that the market remains undersupplied in terms of potential investments relative to the demand.

Not too surprisingly, supply is starting to increase. We have seen some companies enter the space by expanding their own businesses, but there have been some reverse mergers lately too. I had mentioned Refill Energy (REFG.PK) recently (soon to be Medical Cannabis Financial Group), but earlier this month Promap (PMAP.OB) acquired 94% of Advanced Cannabis Solutions (link to 8-K). As an aside, I think that this company is worth considering given the management team and the business model. Investors should keep in the back of their mind that there are many companies that are quietly developing their business models and could become public over time, especially as the regulatory and legal landscapes improve.

Almost every stock in the sector trades in the pink sheets or on the OTC. Most who follow the sector are aware that FINRA issued a warning last week, suggesting that investors should be aware of potential marijuana stock scams. Some may not be aware, but this warning actually follows a series of similar alerts over the past 12 years. Human behavior doesn't change, just the headlines! The advice was a little late and basic, but it certainly drives home the point that there are some people chasing a fast buck. Over time, investors will have better choices and will learn to discern between the fakers and the real deal.

Finally, it's worth noting that there isn't a lot of scrutiny on the sector. Given the small size of the tradeable universe, it's not surprising that these stocks fly under th! e radar o! f Wall Street. The investor base is oriented towards small investors, and my impression is that many of them are young or not particularly experienced when it comes to investing. The "research" that is available tends to be highly promotional and sponsored by companies. Put it all together, and it's not surprising that the stocks experienced a bubble earlier this year. I am hopeful that there will be more independent analysis such as I intend to offer to help investors make informed choices.

Cannabis Universe

I have identified about two dozen potential names, but here are the publicly-traded companies that I am tracking with market caps above $10mm:

(click to enlarge)

Please note that I compiled this data by hand and encourage anyone to let me know if there are potential omissions or errors. Again, I am excluding all market caps less than $10mm. To calculate market cap, I converted all securities without regard to caps potentially imposed by authorized share limitations. My fiduciary assessment is subjective. As most of these stocks are not listed, the basic assumption is that one should expect yellow (caution). I may be too generous, quite frankly, as many of the yellows might considered red in general. The assessment is intended to be relative to the rest of the universe.

Focus Four

Taking into account all of the data I have shared, I want to introduce my take on the most important names to follow. My initial list takes into account not only the market cap, business model and interest-level. These are the stocks that I think merit the most attention (in alphabetical order):

CannaVest (CANV.OB)GW Pharma (GWPH)MedBox (MDBX.PK)Medical Marijuana, Inc. (MJNA.PK)CANV doesn't really trade, as it is held closely by insiders (99.7%, including MJNA). I have a few concerns, including the valuation and s! ome near-! term financial challenges typical of a start-up with just one client looking to expand its customer base, but I like the focus and the fact that it is an SEC filer with a relatively clean history (i.e. none of the baggage of some of these other companies). I have spoken to its outsourced CFO and am impressed by his background (has been CFO or held key financial roles at publicly-traded healthcare companies). CANV is the partner to MJNA that is responsible for manufacturing the CBD (Cannibidiol, the cannabinoid in marijuana that is increasingly viewed as offering substantial medical benefits). I am very concerned about the near-term financials, but this is a pure-play with probably a two-year lead over other companies. I don't see a moat in terms of intellectual property or brands, but they have a good lead in terms of sourcing of supply and penetration into potential customers. Quite simply, they don't appear to have competition at present. The company, then, is a call option on CBD demand taking off. It appears that it could be a supplier to even Big Pharma should medical marijuana research move into the mainstream.

GW Pharma is the only listed company of the entire group, and it has Wall Street coverage as well. They even hold conference calls. Note that the ticker I have shared above represents the ADS. Each share represents 12 shares of the UK-listed stock. There is also a pink-sheet listing (GWPRF.PK). Based in the UK, it has a CBD/THC spray on the market in Europe and could enter the U.S. pending FDA approval. It is currently studying Sativex for multiple sclerosis. The management team has significant industry experience. Here is a link to their website. Perhaps a better place to start is this recent presentation.

Medbox is somewhat controversial. It has the largest market cap of the group, and I was impressed that its CEO presented at the JPM Healthcare Conference earlier this year. The public float, though, is pretty small here too, which led to the massive spike earlier in the year ! (on limit! ed volume). I found it refreshing when the Chairman stated publicly that the stock was overvalued at the time. Medbox makes dispensing machines that have biometric identification controls to limit access. The company has branched off into adjacent areas recently as well, announcing three acquisitions, two of which are now in litigation (Medvend Holdings and Bio-Tech Medical Software). The company successfully closed its purchase of Vaporfection International, maker of the viVape vaporizer.

MJNA was the first publicly-traded company in the space and commands the most attention from investors. The stock is down dramatically from it's all-time high earlier this year, but it is also well above the mid-point of the 2012 trading range. Founded in 2009 by Bruce Perlowin, the "King of Pot", new management came in 2011, turning it into a real business. The company has a lot of different pursuits, but the primary focus appears to be its CBD-based products, where it is really first-to-market with cannabinoids that are legal in all 50 states. I have written extensively on the company, which I believe hasn't been particularly transparent in the past, though I have noted some improvement since April.

Cannabis Calls

Before I share my first two ratings, I want to remind readers that I am not a sell-side analyst. No one should treat what follows as anything other than my opinion. Before making an investment in any stock, one should conduct one's own analysis or consult an investment advisor qualified to assess the suitability of the investment.

My first call will likely not surprise readers. I think that Hemp, Inc. (HEMP.PK) is a SELL.

(click to enlarge)

The stock currently trades at $0.0135, and I am establishing a target of $0.0025. Of course, I have been negative on this since February, when it was $0.08, but the m! ore I hav! e learned the more I have realized how overpriced it was. As I have previously discussed, HEMP appears to be a self-enrichment scheme only. A serious review of its businesses shows that there is little substance. Since my last article that focused on the exchange last year of 193mm Preferred "K" shares for $1.9mm in debt that effectively gives CEO Bruce Perlowin over 1.9 billion shares (1/10 of a penny per share), the company reported its non-audited Q2 results. The bad news is that the company reported sales of only $534K but a net loss of $576K. It appears to me that the company did not close a deal for ScrubNuts that they announced during the quarter.

The good news is that the full share count including conversion of all of the preferred stock is less than I had previously reported, as the company's prior filing was apparently incorrect regarding the outstanding amounts of the preferred stocks. With 1.445 billion common shares and two series of preferred stocks that could add another 2.114 billion shares, the effective number of shares outstanding is slightly above the authorized shares (as majority owner, I assume Perlowin could lift the A/S or implement a reverse split), which suggests a market cap of $48mm. My target is based on a value of $10mm for the ticker and domain names less $1.6mm in liabilities (mainly a loan from Perlowin). So, while HEMP is way down from its peak, I believe that the downside is significant still.

My second call may surprise readers, as I have been accused by some of being a paid basher and worse, but I am initiating MJNA as a HOLD.

(click to enlarge)

The stock is still up in 2012, commands a large market cap and trades with good liquidity. I reviewed the Q2 results earlier this month. Subsequently, CannaVest reported a terrible quarter, with sales of just $108K. On the other han! d, its DT! C Chill was finally lifted and the company announced a small distribution deal for its CBD gum to Russia and other Commonwealth of Independent States. While I don't think the DTC Chill was really much of an issue, the distribution deal, while likely not a material financial contributor on the bottom-line in the near-term, is an important step in its commercialization efforts.

I had hoped to be more enthusiastic about the stock, but the second quarter was disappointing, as I have previously described. Had it not been for the frenzy caused by CNN Chief Medical Correspondent Dr. Sanjay Gupta's dramatic reversal in his views about medical marijuana that he described in documentary "Weed", I think that we might have seen the stock drop below $0.10 following the report. After trading as high as $0.26 going into the report, MJNA has fallen into the $0.10-.15 range I suggested after they reported. While I still see risk to as low as $0.05, I think that the company, if it gains some traction in its CBD products, could regain investor enthusiasm. While this isn't my prediction (nor is $0.05), the stock could quickly return to $0.25. Imagine if Dr. Oz were to endorse medical marijuana! The near-term bull case takes into account the Gupta effect, which could lead to a bounce in sales of their Dixie Botanicals, CanChew CBD gum and RSHO concentrated CBD.

From a technical perspective, my read is that there is a lot of support at $0.12, but we sure are close to that level. I would expect a slight breach should we trade to there, similar to the slight breach of the $0.10 level in late June. I would get more bullish at a price level below $0.10 given what we know right now, perhaps $0.08, though this is above my "risk" level. The main things that concern me in the near-term include the pending trial of its former CEO Michael Llamas (who, in my opinion, is still involved through his ownership of CannaBANK, a controlling investor of MJNA), the hazy status of the authorized share count (and, more importantly, th! e handcuf! fs currently imposed with the O/S of 946mm compared to a "management-capped" A/S of 950mm) and the unresolved capital structure at CannaVest (MJNA could see its investment diluted significantly under certain scenarios, and the current value of the investment accounts for the majority of MJNA's market cap).

Conclusion

The landscape is rapidly changing with respect to the legal and regulatory environments for recreational and medical marijuana as well as hemp. While it's very early in the game for the publicly-traded universe of companies with an oar in the water, it's clear that investor appetite for cannabis-related stocks remains quite high. There is no denying the "Green Rush", which promises to be a win-win-win over time for consumers, businesses and the government. The data and opinions that I have shared will hopefully help investors as they assess the risks and opportunities in the sector. I encourage readers to let me know if there are topics of interest to explore in future articles. Similarly, if any reader has any specific insight that they would like to share with my audience, I invite him or her to consider being interviewed.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments :

Post a Comment