DELAFIELD, Wis. (Stockpickr) -- Trading stocks that trigger major breakouts can lead to massive profits. Once a stock trends to a new high or takes out a prior overhead resistance point, then it's free to find new buyers and momentum players who can ultimately push the stock significantly higher.

Must Read: Warren Buffett's Top 10 Dividend Stocks

Breakout candidates are something that I tweet about on a daily basis. I frequently tweet out high-probability setups, breakout plays and stocks that are acting technically bullish. These are the stocks that often go on to make monster moves to the upside. What's great about breakout trading is that you focus on trend, price and volume. You don't have to concern yourself with anything else. The charts do all the talking.

Trading breakouts is not a new game on Wall Street. This strategy has been mastered by legendary traders such as William O'Neal, Stan Weinstein and Nicolas Darvas. These pros know that once a stock starts to break out above past resistance levels and hold above those breakout prices, then it can easily trend significantly higher.

With that in mind, here's a look at five stocks that are setting up to break out and trade higher from current levels.

Must Read: 10 Stocks Carl Icahn Loves in 2014

Five Prime Therapeutics

A clinical-stage biotechnology stock that's moving very quickly within range of triggering a near-term breakout trade is Five Prime Therapeutics (FPRX), which focuses on the discovery and development of protein therapeutics that block cancer and inflammatory disease processes. This stock has been hit hard by the bears so far in 2014, with shares down 23%.

If you take a look at the chart for Five Prime Therapeutics, you'll notice that this stock has just started to bounce higher here right above its 50-day moving average of $11.93 a share. That bounce is coming after shares of FPRX recently formed a major bottoming chart pattern, since this stock found buying interest each time it pulled back to right around $11.40 to $11.30 a share. Shares of FPRX are now quickly moving within range of triggering a near-term breakout trade.

Traders should now look for long-biased trades in FPRX if it manages to break out above some key near-term overhead resistance levels at $12.91 to $12.94 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 106,706 shares. If that breakout triggers soon, then FPRX will set up to re-test or possibly take out its next major overhead resistance levels at its 200-day moving average of $14.33 to $15 a share, or even $16.94 a share.

Traders can look to buy FPRX off weakness to anticipate that breakout and simply use a stop that sits right below its 50-day moving average of $11.93 a share. One can also buy FPRX off strength once it starts to clear those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Must Read: 5 Stocks Insiders Love Right Now

ANI Pharmaceuticals

Another stock that's starting to move within range of triggering a big breakout trade is ANI Pharmaceuticals (ANIP), which develops, manufactures and markets branded and generic prescription pharmaceuticals. This stock has been in play with the bulls so far in 2014, with shares ripping higher by 49%.

If you take a glance at the chart for ANI Pharmaceuticals, you'll see that this stock has just started to rip higher here right above its 50-day moving average of $28.16 and back above its 200-day moving average of $29.42 a share. That sharp rip to the upside on Friday also pushed shares of ANIP into breakout territory, since the stock took out some near-term overhead resistance at $29.74. Shares of ANIP are now quickly moving within range of triggering a much bigger breakout trade above some key overhead resistance levels.

Traders should now look for long-biased trades in ANIP if it manages to break out above some near-term overhead resistance levels at $30.36 to $30.45 a share and then above some past resistance levels at $31.88 to $32.75 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 174,094 shares. If that breakout develops soon, then ANIP will set up to re-test or possibly take out its next major overhead resistance levels at $36.34 to its 52-week high at $38.74 a share.

Traders can look to buy ANIP off weakness to anticipate that breakout and simply use a stop that sits right below its 50-day moving average of $28.16 a share or just below some more near-term support at $27 a share. One could also buy ANIP off strength once it starts to clear those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Must Read: Sell These 5 Toxic Stocks Before November

Kratos Defense & Security Solutions

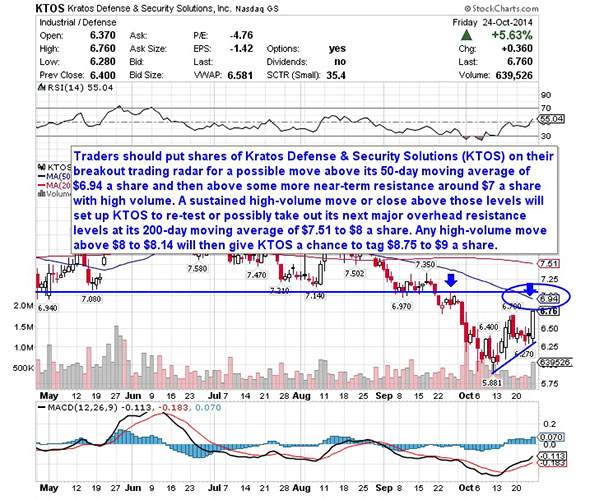

A security and protection services stock that's starting to trend within range of triggering a near-term breakout trade is Kratos Defense & Security Solutions (KTOS), which provides mission critical products, solutions and services primarily for the U.S. Government. This stock has been downtrending a bit so far in 2014, with shares off by 11.9%.

If you take a glance at the chart for Kratos Defense & Security Solutions, you'll notice that this stock spiked sharply higher here on last Friday right above some near-term support at $6.27 a share with strong upside volume flows. Volume on Friday registered 640,000 shares, which is well above its three-month average of 397,255 a shares. That spike also pushed shares of KTOS into breakout territory, since the stock took out some near-term overhead resistance at $6.70 a share. Shares of KTOS are now quickly moving within range of triggering another near-term breakout trade.

Traders should now look for long-biased trades in KTOS if it manages to break out above its 50-day moving average of $6.94 a share and then above more near-term support around $7 a share with high volume. Watch for a sustained move or close above those levels with volume that registers near or above its three-month average action of 397,255 shares. If that breakout materializes soon, then KTOS will set up to re-test or possibly take out its next major overhead resistance levels at its 200-day moving average of $7.51 to $8 a share. Any high-volume move above $8 to $8.14 will then give KTOS a chance to tag $8.75 to $9 a share.

Traders can look to buy KTOS off weakness to anticipate that breakout and simply use a stop that sits right below some near-term support at $6.27 a share. One can also buy KTOS off strength once it starts to move above those breakout levels share with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Must Read: Book Double the Gains With These Shareholder Yield Champs

Castlight Health

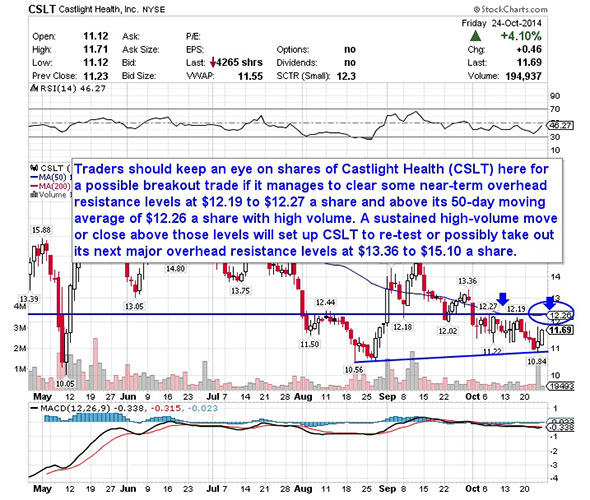

A cloud-based software player that's starting to trend within range of triggering a near-term breakout trade is Castlight Health (CSLT), which has software that enables enterprises to control their health care costs. This stock has been destroyed so far in 2014 by the sellers, with shares down huge by 70%.

If you take a glance at the chart for Castlight Health, you'll see that this stock has just started to bounce right above some near-term support at $10.84 a share. That bounce is also coming above some previous support from mid-August at $10.56 a share. Shares of CSLT are now starting to trend within range of triggering a near-term breakout trade above some key overhead resistance levels.

Traders should now look for long-biased trades in CSLT if it manages to break out above some near-term overhead resistance levels at $12.19 to $12.27 a share and above its 50-day moving average of $12.26 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average volume of 1.37 million shares. If that breakout begins soon, then CSLT will set up to re-test or possibly take out its next major overhead resistance levels at $13.36 to $15.10 a share.

Traders can look to buy CSLT off weakness to anticipate that breakout and simply use a stop that sits right below some key near-term support levels at $10.84 to $10.56 a share. One can also buy CSLT off strength once it starts to bust above those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Must Read: 5 Stocks Under $10 Set to Soar

Infoblox

My final breakout trading prospect is communication equipment player Infoblox (BLOX), which develops, markets and sells automated network control solutions worldwide. This stock has been destroyed by the sellers so far in 2014, with shares off sharply by 53%.

If you look at the chart for Infoblox, you'll notice that this stock just recently formed a double bottom chart pattern at $13.38 to $13.31 a share. Following that bottom, shares of BLOX have started to uptrend right above its 50-day moving average. That uptrend is now quickly pushing shares of BLOX within range of triggering a major breakout trade above some key near-term overhead resistance.

Traders should now look for long-biased trades in BLOX if it manages to break out above Friday's intraday high of $15.29 a share and then above some key near-term overhead resistance at $15.44 a share with high volume. Look for a sustained move or close above those levels with volume that registers near or above its three-month average action of 913,968 shares. If that breakout gets set off soon, then BLOX will set up to re-fill some of its previous gap-down-day zone from May that started just above $20 a share.

Traders can look to buy BLOX off weakness to anticipate that breakout and simply use a stop that sits just below its 50-day moving average of $13.95 a share, or near those double bottom support levels. One can also buy BLOX off strength once it starts to clear those breakout levels with volume and then simply use a stop that sits a conformable percentage from your entry point.

Must Read: 10 Stocks Billionaire John Paulson Loves in 2014

To see more breakout candidates, check out the Breakout Stocks of the Week portfolio on Stockpickr.

-- Written by Roberto Pedone in Delafield, Wis.

RELATED LINKS:

>>How to Trade the Market's Most-Active Stocks

>>3 Stocks Under $10 in Breakout Territory

>>Buy These 5 Financial Sector Breakout Stocks in October

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Roberto Pedone, based out of Delafield, Wis., is an independent trader who focuses on technical analysis for small- and large-cap stocks, options, futures, commodities and currencies. Roberto studied international business at the Milwaukee School of Engineering, and he spent a year overseas studying business in Lubeck, Germany. His work has appeared on financial outlets including

CNBC.com and Forbes.com. You can follow Pedone on Twitter at www.twitter.com/zerosum24 or @zerosum24.

No comments :

Post a Comment